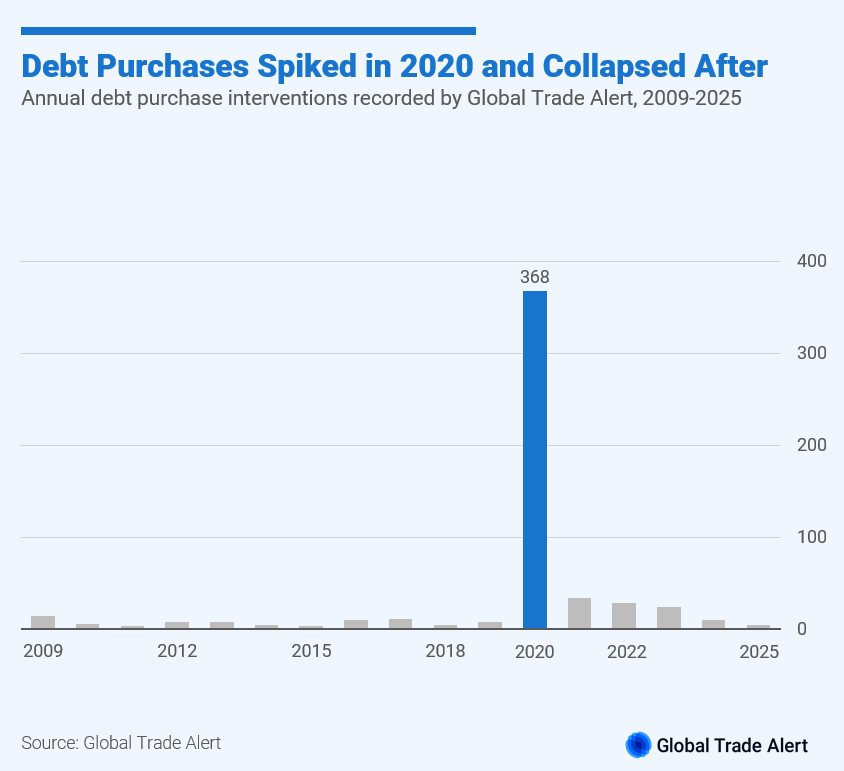

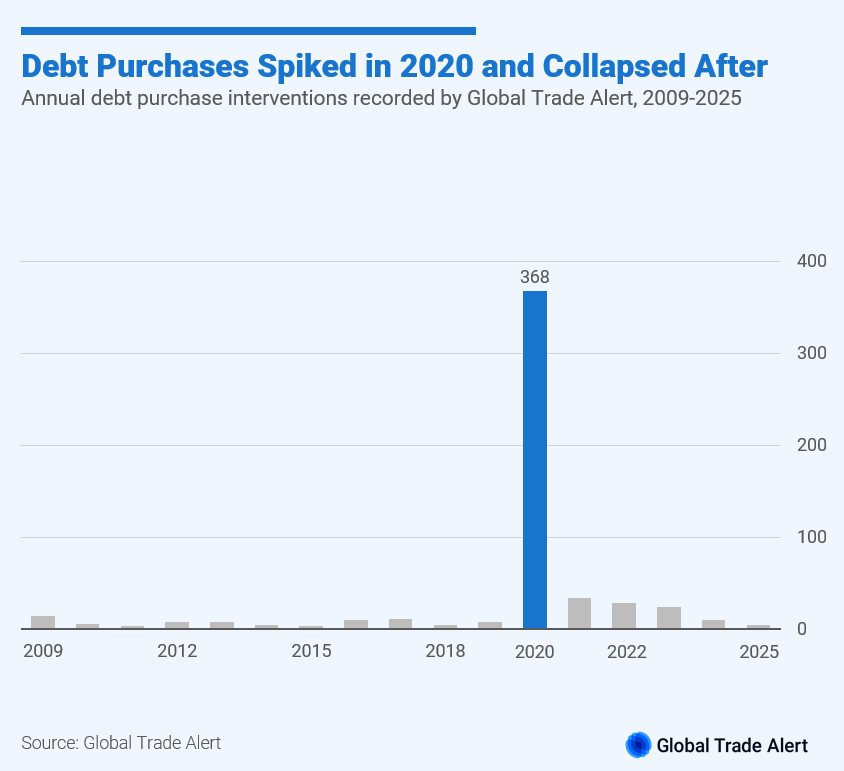

The 2020 Spike and Collapse

The 552 recorded debt purchase interventions cluster around one moment. The year 2020 accounts for 368 interventions: 67% of all activity since 2009. Before that, annual activity averaged 7.5. By 2025, it had fallen to 5.

A methodological note: the 2020 figure reflects transaction-level recording. The Federal Reserve's Secondary Market Corporate Credit Facility generated 208 database entries, one for each company whose bonds the Fed purchased: AT&T, Apple, Anheuser-Busch, and dozens more. The Bank of England's COVID Corporate Financing Facility generated 102 entries. These represent two programmes, not 310 separate policy decisions. The spike is real, but the magnitude reflects counting granularity.

Still, the trajectory is unambiguous. The Fed recorded 208 interventions in 2020, one in 2022, none thereafter. The Bank of England recorded 102 in 2020, 17 in 2021, none thereafter. Canada recorded 47 in 2020, then 2, then none.

Central banks deployed debt purchases as emergency liquidity support. When credit markets stabilised, they withdrew.

Implementation Channels Reversed with the Crisis

Debt purchase channels reversed during the pandemic, then reversed again after.

Before 2020, public financial institutions managed 67% of debt purchase programmes. National governments accounted for 17%. Development banks like BNDES dominated. In 2020, central banks implemented 98% of debt purchase programmes. Public financial institutions fell to 2%. After 2020, the pattern reverted. Public financial institutions now manage 52% of the reduced activity. National governments account for 43%.

Equity stakes showed a steady drift toward public financial institutions. Debt purchases show crisis-driven reversal: central banks dominate in emergencies, development banks in normal times.

Brazil: Standing Development Finance

Brazil's debt purchase activity does not track the COVID cycle. BNDES has purchased corporate debentures since 2009 at a steady pace. The programme predates the pandemic and continues after it.

BNDES's 2024 credit agreement with Concessionária do Sistema Rio-São Paulo for highway infrastructure illustrates the pattern. Its 2025 financing for VLI Multimodal's railway expansion continues it. These are development finance, not crisis interventions.

Brazil accounts for 7 of 15 debt purchase interventions in 2024–2025. France and Germany contribute EIB green bond subscriptions. India records budget programmes. Russia responds to sanctions.

Debt purchases can function as standing development tools where institutional infrastructure exists. BNDES has operated a debentures programme for decades. Most countries lack equivalent machinery. The EIB's climate bond subscriptions suggest a second pathway: standing green finance rather than development finance.

Russia: A Different Crisis

Russia's 2022–2023 debt purchase activity represents a crisis response of a different kind. The Ministry of Finance purchased bonds from Rostec, the state defence conglomerate, and NLK-Finans, a leasing company. Earlier interventions targeted Russian airliners facing Western sanctions.

This is a crisis response to geopolitical pressure rather than the pandemic. The pattern confirms rather than contradicts the instrument's emergency character.

What the Contrast Reveals

Debt purchases and equity stakes tell different stories about state capitalism's evolution.

Equity stakes show governments investing beyond crisis. The 2025 data includes lithium extraction, electric aviation, and semiconductor manufacturing: building capabilities, not rescuing firms.

Debt purchases show governments retreating after a crisis. The 2020 spike was extraordinary. The 2025 trickle is not. Central banks deployed the instrument, achieved their objective, and withdrew.

The contrast matters for monitoring. Equity stakes require sustained attention because the pattern is shifting. Debt purchases require less: emergency deployment, emergency withdrawal. Brazil's development bank programme and the EIB's green bonds represent exceptions where specialised infrastructure enables standing use. Russia's sanctions response confirms the rule by representing a different emergency.

Some tools of state capitalism are becoming standing instruments. Debt purchases, in most economies, are not among them.