In 2025, equity stakes decoupled from economic crisis response. The US government took stakes in strategic companies after fifteen years without equity activity. The UK backed lithium extraction. Brazil funded electric aviation. China targeted semiconductors.

Equity stakes differ from other forms of state capitalism. Loans cap returns at principal plus interest while exposing governments to default risk. Grants defray costs but offer no prospect of return. Equity involves sharing both downside risk and upside potential. It provides governance rights and claims on future profits.

This piece is the second in our analytical series on state capitalism. The first instalment introduced a nine-instrument taxonomy and identified three patterns: governments are back in business, opacity dominates, and institutional channels vary considerably by country.

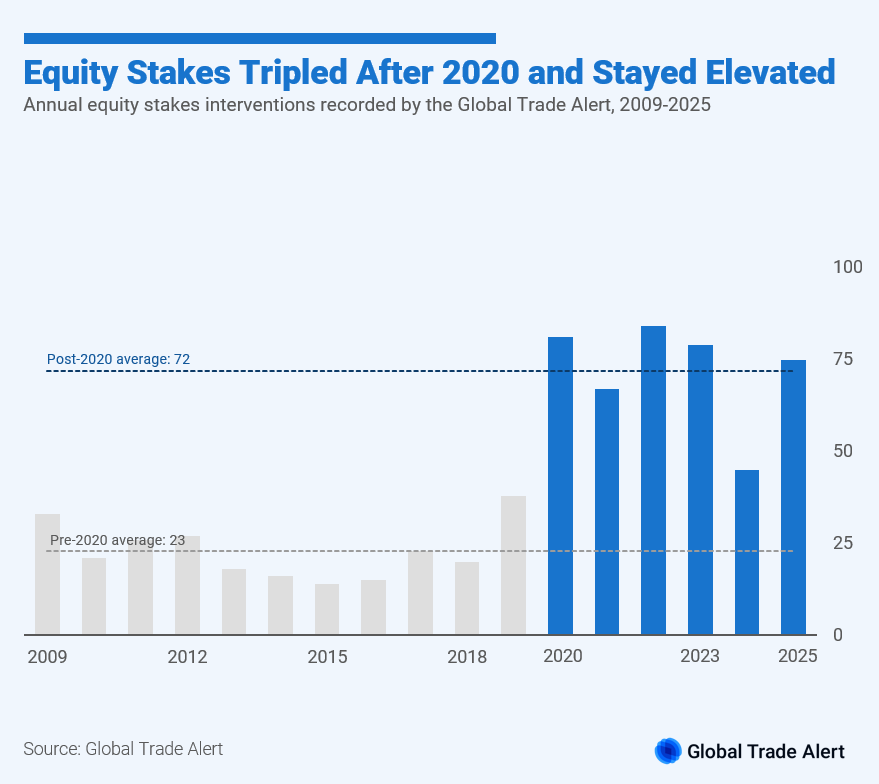

This analysis covers 704 equity stake interventions recorded between 2008 and 2025.

The 2025 Break

Average annual equity stake interventions rose from 23 (2009–2019) to 72 (2020–2025). Specific annual surges track identifiable economic shocks: the 2009 financial crisis, South African bailouts in 2019, COVID-19 in 2020, Russia's invasion of Ukraine in 2022-23. But 2025 is the exception.

China pioneered the shift from crisis response to industrial policy. Between 2020 and 2025, China recorded 22 equity-stake interventions, with 91% targeting strategic technologies rather than distressed firms. Out of the recorded interventions, 59% target semiconductors. The USD 1.9 million equity investment in Yangtze Memory Technologies Co is an example. This investment was made via the National Integrated Circuit Industry Investment Fund (“The Big Fund”).

The 2025 data shows this approach spreading. The UK, Brazil, Saudi Arabia, and the United States deployed equity in strategic sectors without crisis triggers.

The UK marks the sharpest departure from its crisis-era approach. The National Wealth Fund's USD 42 million equity commitment to Cornish Lithium in September 2025 targets lithium extraction, a critical raw material, not a distressed firm. The 2025 injection advances feasibility studies and low-carbon processing technology.

Brazil and Saudi Arabia deployed equity in sectors with no preceding shock. Brazil's BNDESPAR's USD 14 million equity investment in Eve Air Mobility in August 2025 targeted electric vertical take-off and landing aircraft development. The beneficiary is an Embraer Group subsidiary. No crisis preceded the investment. Saudi Arabia's Public Investment Fund acquisition of shares in MBC Group in 2025 targeted media and entertainment. The PIF cited advanced technologies and localised content production as strategic priorities.

The United States took three equity stakes in 2025 after fifteen years without one. In 2025, the US Administration has taken stakes in MP Materials, Intel, Lithium Americas, and announced possible investments in other firms across mining and advanced technology. All announcements target strategic sectors: critical minerals, energy, and software.

Institutional Channels Vary

Government channels dominate equity stake implementation. Direct government action accounts for 65% of all interventions. At the programme level, the share reaches 81%.

Cross-country preferences differ sharply. Japan routes 98% of equity programmes through public financial institutions (PFI). Italy follows at 76%, the UK at 64%, Canada at 63%. India, South Africa, and Türkiye recorded zero PFI involvement.

Channel preferences also shift over time. During 2009–2019, public financial institutions implemented only 4.5% of equity-related programmes. After 2020, that share rose to one-third. By 2024–2025, public financial institutions overtook government channels at the programme level.

New institutional infrastructure reinforces this trend. Germany's December 2025 launch of the EUR 30 billion Germany Fund channels equity to industry, energy, defence, and critical materials. KfW coordinates the fund. The stated objective: direct private capital toward innovation, supply chain resilience, and "key future sectors."

The Shift

Crisis response explains most historical equity stake activity, but the 2025 pattern does not fit. The clustering around 2009, 2019, 2020, and 2022-23 fits the emergency-tool interpretation. The United States moved from one intervention in fifteen years to three confirmed and three announced in a single year, all in strategic industries. UK and Brazil activity spiked without crisis triggers. The National Wealth Fund backed lithium extraction. BNDESPAR backed electric aviation. Saudi Arabia deployed equity for media and advanced technologies. China targeted semiconductor development.

Equity stakes are shifting from an emergency tool to an industrial policy instrument. The 2025 pattern breaks from fifteen years of data. Whether this becomes routine warrants monitoring.