Latest Update of 15 January 2026, Published in June 2025

Inclusion of:

- Section 232 tariffs on semiconductors announced on 14 January 2026

What Is Tariff Stacking?

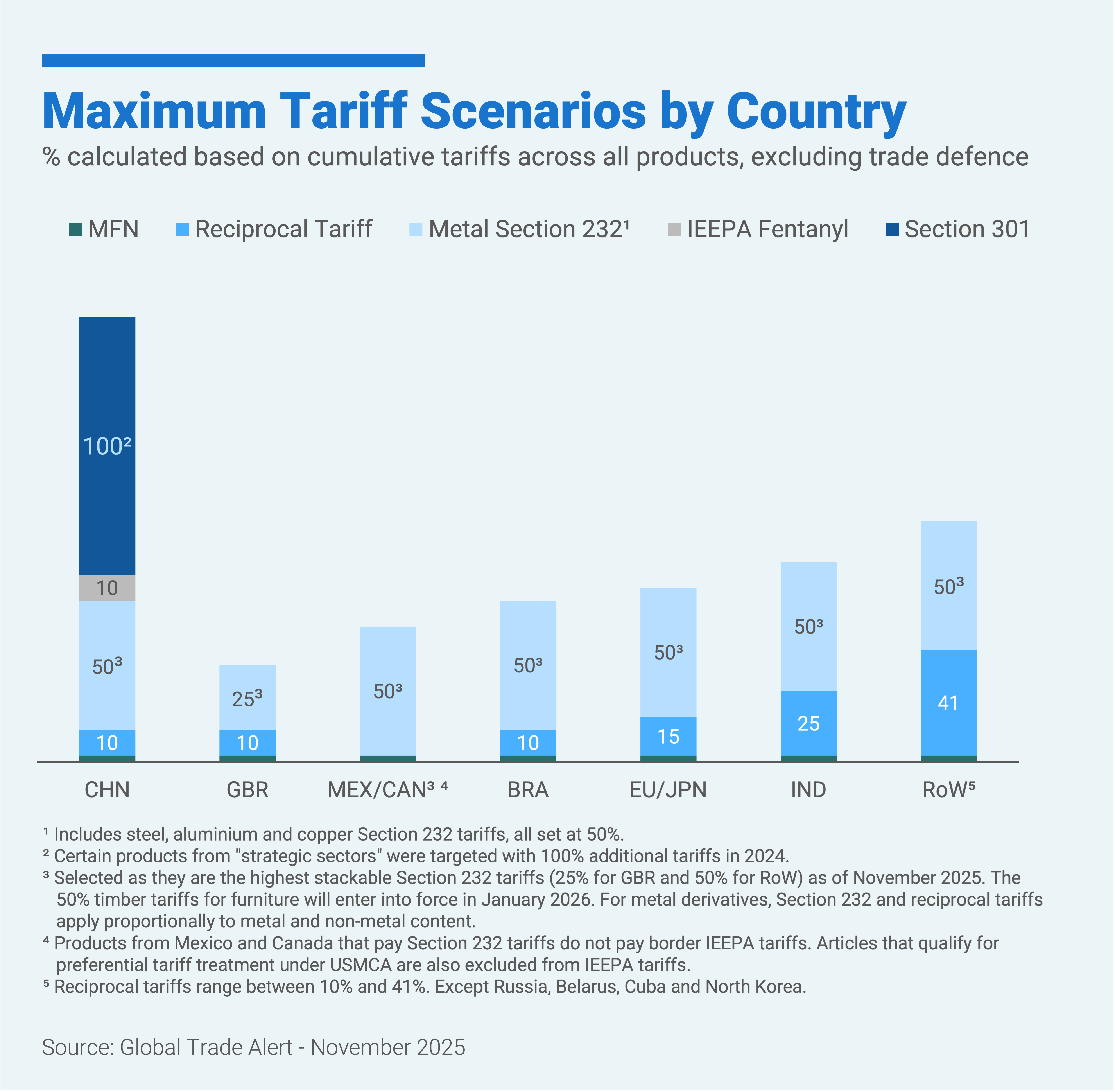

Tariff stacking occurs when multiple tariffs apply to the same imported product under separate trade actions. For example, an input from abroad might face a national security tariff under Section 232, plus the additional “reciprocal tariff”. This creates cumulative duties that increase the product's final effective rate.

Do All US Tariffs Stack Up?

No. While some tariffs apply cumulatively, others are mutually exclusive. In April 2025, Executive Order 14289 first established rules governing cumulative application, often called "stacking" multiple tariffs on imported products. EO 14289 created a hierarchy where certain tariff regimes supersede others and cannot stack. However, not all regimes are covered by the order. Those not covered by any rule can cumulatively apply on top of any other applicable tariff.

Recent announcements have shifted away from automatic tariff stacking. The wave of additional duties imposed since August 2025 reflects this trend. The latest Section 232 metal tariffs on copper and derivatives, for example, provided clear guidance from the outset about whether they take precedence over other tariffs, defer to them, or apply proportionally based on content. The Section 232 timber tariffs imposed clearer limits on stacking and explicitly prohibited cumulative application with certain overlapping regimes. Most recently, the Section 232 tariffs on semiconductors introduced strict non-stacking rules, explicitly exempting covered products from reciprocal tariffs, trafficking border tariffs, and other Section 232 tariffs.

Which And How Do US tariffs Stack?

1. Semiconductor Tariffs Override Most Others

The

Proclamation and subsequent

CBP guidance on the Section 232 tariffs on semiconductors establish a largely exclusive tariff regime for covered advanced computing chips. The proclamation explicitly states that any product subject to the new 25% semiconductor tariff is exempt from the following:

As a result, semiconductor tariffs do not stack in these circumstances. However, the exemption is not universal. The semiconductor tariffs may still stack with other measures, including IEEPA tariffs applicable to China, Brazil, and India.

2. Transport Tariffs Supersede S232 Metal, Timber and IEEPA Tariffs

When an imported product faces Section 232 tariffs on auto or autoparts, or Section 232 tariffs on MHDVs, MHDVPs, and buses, it will NOT be subject to Section 232 tariffs on aluminium, Section 232 tariffs on steel, Section 232 tariffs on copper, Section 232 tariffs on timber, or IEEPA tariffs on imports from Canada, Mexico, Brazil and India. In a nutshell, Section 232 transport tariffs (auto and MHDVs) supersede Section 232 materials tariffs (aluminium, copper, steel, timber) and IEEPA tariffs.

3. Other Section 232 Tariffs Override Most IEEPA Tariffs

Products subject to Section 232 aluminium, steel, copper, or timber tariffs— but not semiconductors, automotive or automotive parts tariffs— are exempt from IEEPA tariffs. This applies to both the reciprocal tariffs and the country-specific ones targeting Canada, Mexico, Brazil and India.

In its most recent iteration, Proclamation 10976 of 29 September and its related CBP guidance of 10 October specified that products covered by the additional timber tariffs are not subject to IEEPA reciprocal tariffs. This means that Section 232 duties take precedence wherever both regimes might otherwise apply.

This interaction between Section 232 and IEEPA regimes creates divergent outcomes. For Mexico and Canada, the lack of USMCA-based exclusions under Section 232 represents a disadvantage. IEEPA fentanyl-related tariffs (25% for Mexico, 35% for Canada) exempt exports meeting USMCA rules of origin. By contrast, Section 232 metal tariffs are fixed at 50%, and timber duties range from 10% to25 % —with some categories scheduled to increase to 50% in January 2027— offering no comparable exemptions.

On the other hand, some Canadian timber exporters now benefit from lower effective duties. Starting 14 October 2025, Canadian softwood lumber under HS 4403.11 now falls under a 10% Section 232 additional tariff instead of being hit by the 35% IEEPA duty (if non-USMCA).

Finally, in certain instances, Section 232 tariff coverage is determined by product descriptions rather than solely by HS codes. This creates situations where specific HS codes may appear to fall under both Section 232 and reciprocal tariff regimes. For example, the timber Proclamation’s annex indicates that certain HTSUS codes (9403.40.9060, 9403.60.8093, and 9403.91.0080) are subject to both systems. The annex also clarifies that products under these codes described as "wooden kitchen cabinets or vanities or parts of wooden kitchen cabinets or vanities" fall under Section 232 tariffs, while those described as "other than" are not subject to Section 232 tariffs, making them subject to reciprocal tariffs instead.

4. Proportional Application of Steel/Aluminium Tariffs and Treatment of Non-Metal Content

The 3 June and 31 July guidances state that Section 232 steel, aluminium and copper tariffs and other additional tariffs can now apply to the same product based on its content. Section 232 tariffs now only apply to the metal content of imported products. Non-steel, aluminium, and copper contents face applicable additional tariffs (for instance, reciprocal tariffs).

This change improves market access for foreign products by narrowing the Section 232 tariff scope to only metal components. As of early August 2025, these tariffs (50%) exceed others, such as current reciprocal tariffs (10%-41%). Reducing the applicability proportion decreases the final effective rate.

Simultaneously, the measure expands the potential for other duties on non-metal portions previously exempt under Section 232. Under the original EO 14289 hierarchy, reciprocal tariffs did not apply to products already facing Section 232 tariffs (50%). This development could worsen market access for foreign products when additional duties exceed Section 232 rates, as occurred with China's reciprocal tariffs (125%) before the temporary suspension on 14 May 2025.

5. Tariff Stacking with the UK, the EU, and Japan

The bilateral deals signed between the US and the UK, EU and Japan also have implications for the extent to which tariffs can stack. Special tariff rules apply to these countries, including caps on total duties and coordinated use of MFN tariffs and supplemental measures. For Japan and the EU, the US limits total auto tariffs to a combined maximum of 15%, encompassing both the MFN rate and any Section 232 duties. For goods subject to reciprocal tariffs, no additional duty is applied if the MFN rate already reaches 15%; if the MFN rate is lower, additional duties are imposed to bring the total up to 15%. For the United Kingdom, the US applies a combined 10% tariff on automobiles. For most other products, a 10% reciprocal tariff is added on top of existing MFN duties, subject to certain exemptions.

For all other cases, duties can fully stack:

-

Unaffected by Hierarchy EO: General MFN tariff, Section 301 tariffs, Reciprocal Tariffs, trade defence actions are not affected by the EO 14289 and may still apply cumulatively.

-

Steel, Aluminium and Copper Stacking: If a product is covered by steel, aluminium and copper tariffs, and is not subject to the auto or IEEPA tariffs, all Section 232 tariffs apply. Each tariff applies to its respective metal content.

Table 1 summarises whether a tariff regime is subject to hierarchy rules or can be stacked:

Notes:

-

Effective 1 August, the “reciprocal tariffs” range between 10% and 41% for all countries except Canada, Mexico, and USHTS Column II countries (Cuba, Belarus, North Korea, Russia).

-

Bilateral deals with several jurisdictions have been announced under this regime: https://globaltradealert.org/reports/Real-Time-Information-on-Trump-Trade-Deals

-

Metal content faces metal-specific tariffs (Section 232); non-metal content faces reciprocal tariffs separately without stacking.

Other Sources We Are Watching