The United States’ new tariff policy has met a restrained response across South America. Except for Brazil, most nations have relied on trade ties and tariff advantages to avoid confrontation. All of this while deepening their economic pivot toward China. Over the past decade, Beijing has overtaken Washington as the top trading partner for much of the region. This shift marks a broader strategic realignment that US tariffs may only hasten. To remain influential, Washington should move beyond punitive measures and pursue a more constructive regional engagement strategy.

The US imposed "reciprocal tariffs" on South American trading partners in 2025. Brazil faced the harshest measures with an accumulated additional duty of 50% on many exports to the US (10% reciprocal plus a 40% ad-hoc surcharge). Section 232 sectoral investigations on copper and timber exports, both important South American exports, were also launched. Yet outside Brazil, the region has dodged the tariff spotlight. Most countries have refrained from direct confrontation or retaliatory measures because they maintain tariff-derived competitive advantages and long-term trade relationships with the US. Over two decades of deepening economic ties with China have further strengthened this position. This dynamic may pose a strategic challenge to US influence in Latin America in the future.

Competitive Advantage Remains

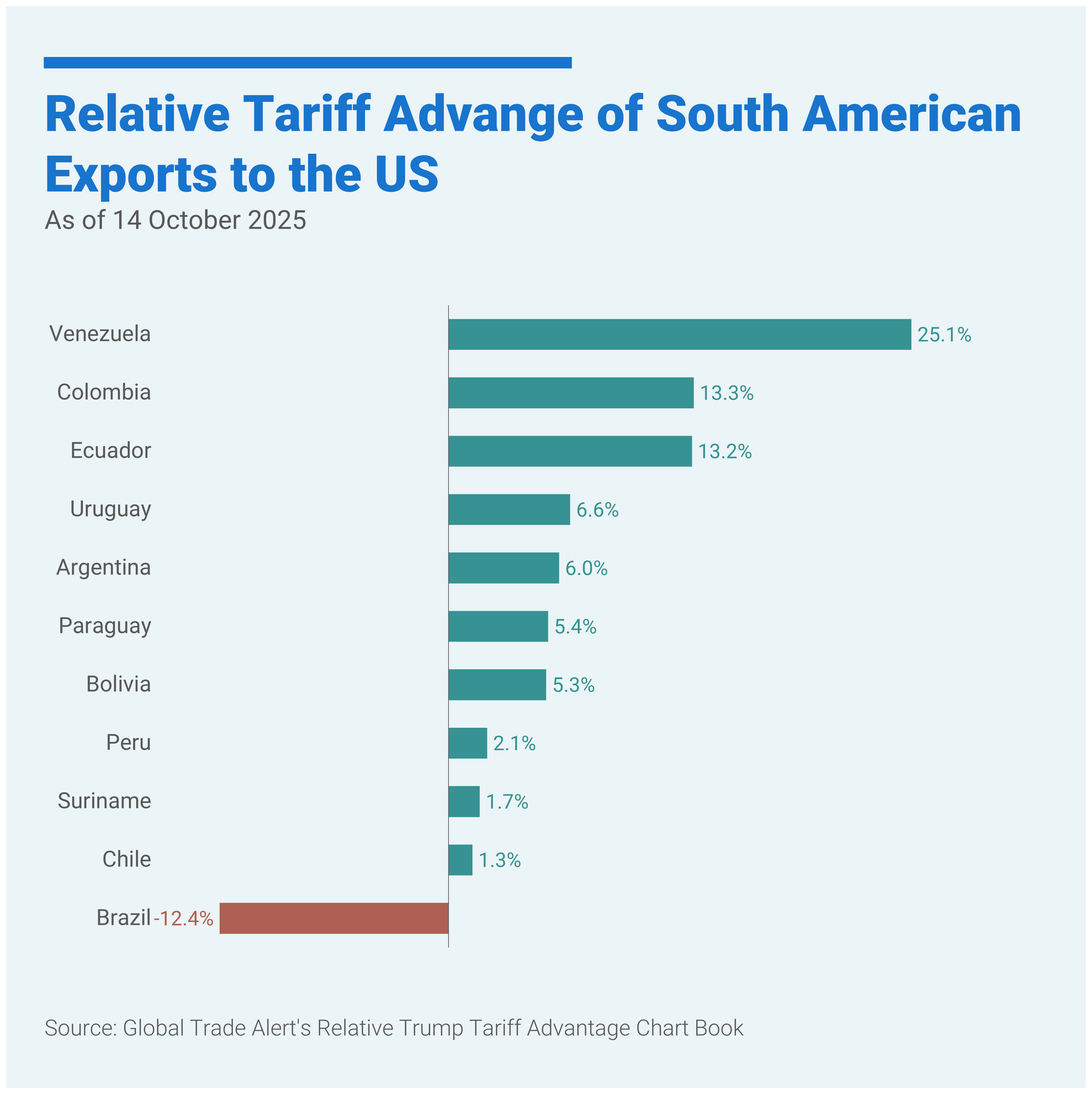

South American exports continue to enjoy competitive edges that allow them to absorb tariff pressure or benefit from exclusions (Figure 1). South American countries face a baseline "reciprocal tariff" (10% or 15%), while competitors from other regions face even steeper tariffs (the highest being up to 41%). Even with the recent Section 232 tariffs on timber products, Figure 1 shows the competitive advantage that South American exports possess. Additionally, copper concentrate (HS code 2603) and refined copper (HS codes under 7403) from Chile and Peru have also been excluded from Section 232 tariff measures. This carve-out preserves the competitiveness of arguably one of the region's most valuable exports. Chile and Peru rank amongst the world's largest copper producers, making this exclusion particularly significant.

Leverage Through Trade Relationships and Surplus

FTAs or political affinity allowed several South American countries to engage through dialogue rather than engaging in tariff escalation. Colombia, Chile, and Peru benefit from existing US trade agreements that provide institutional channels for negotiation. With the recent exemption of Colombia, these frameworks have allowed the parties to address disputes in dialogue, mitigating the risk of abrupt tariff measures. Both Chile and Peru have actively leveraged these frameworks during bilateral negotiations with the US. Although Argentina lacks an FTA with the United States, the Trump–Milei alignment has brought the two governments closer. Buenos Aires has renewed its efforts to pursue a trade deal with Washington following the imposition of reciprocal tariffs. Milei’s recent visit to Washington DC has fueled reports that a bilateral trade deal may be announced “soon”.

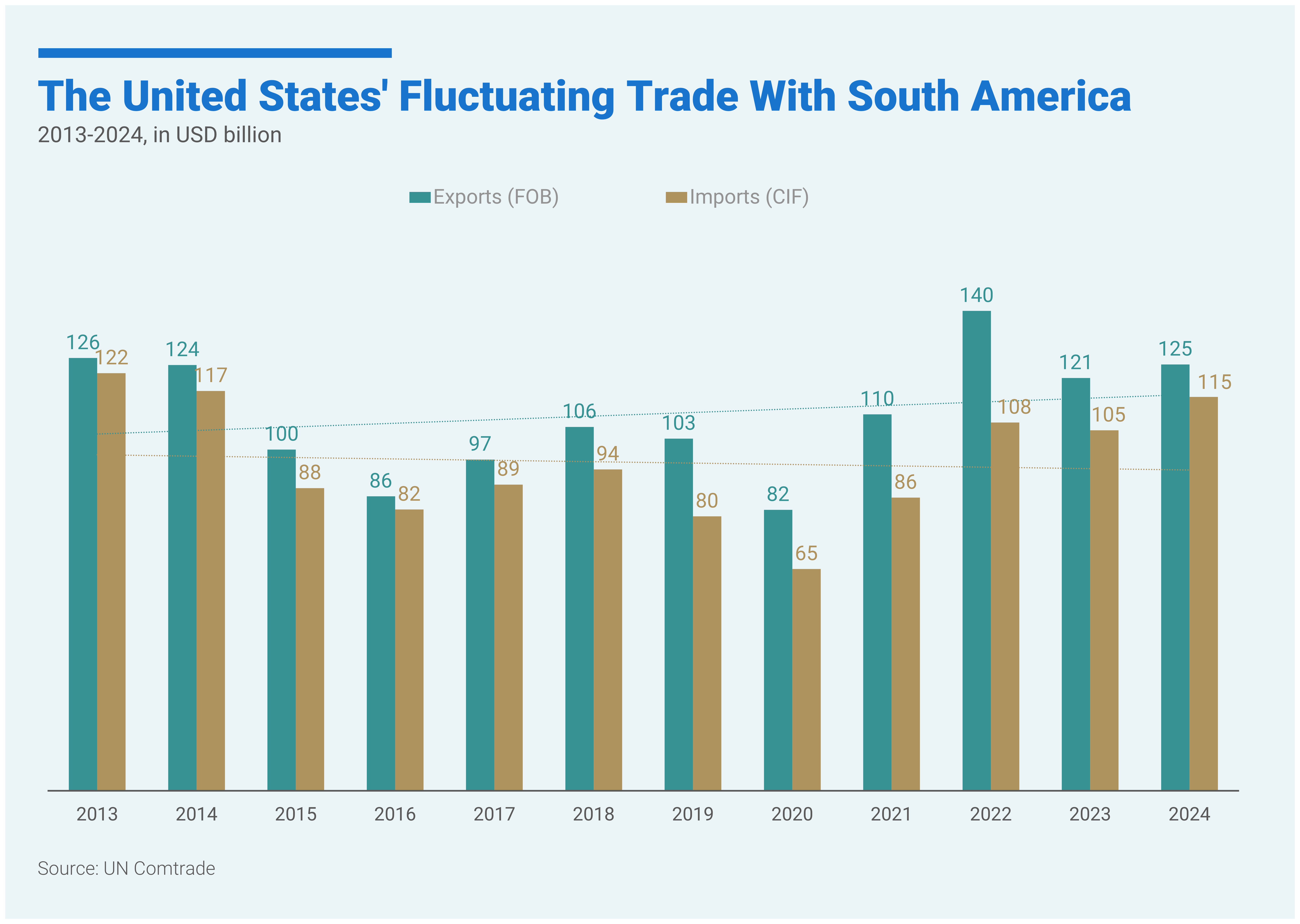

The US has a trade surplus with the region, giving the region leverage when negotiating and maintaining lower tariff levels (Figure 2). US imports from South America declined from USD 122 billion CIF in 2013 to USD 115 billion in 2024. This represents a drop of approximately 6% (Figure 3). US exports fell at a lower cumulative rate of 1.5%, generating a constant trade surplus for the US. All South American countries except Bolivia, Ecuador and Venezuela maintain positive trade relationships with the US. For these three countries, the US has been consistently reducing imports with accumulated reductions of -59%, -24% and -81% respectively for the 2013-2024 period.

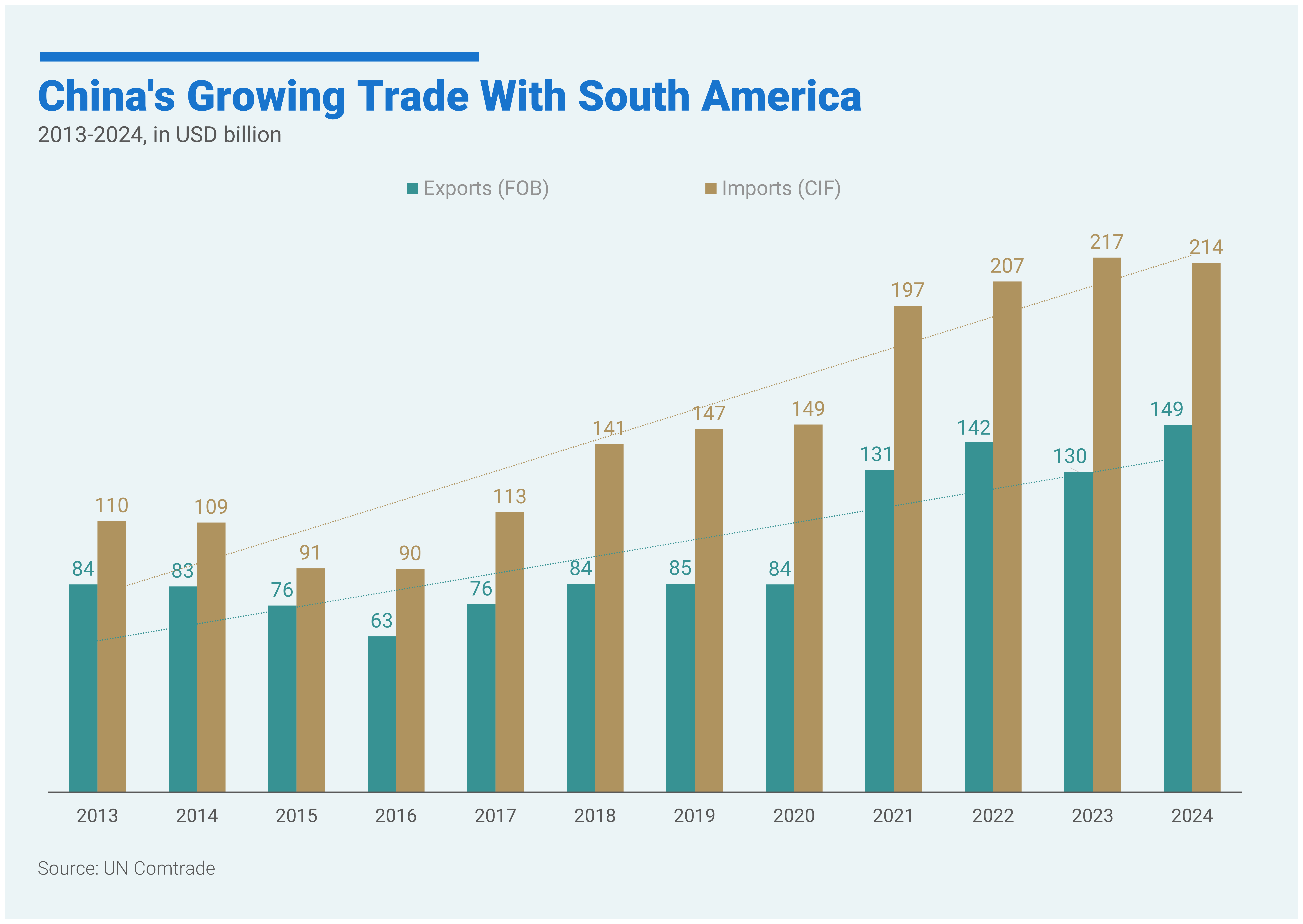

China Offers Alternative Economic Partnership

South American trade with China has risen uninterrupted for over a decade, unlike trade with the US (Figures 3 and 4). China now accounts for 28% of South America's total exports, surpassing the US (16%). The scale becomes clear when examining specific trade flows: China imported over USD 214 billion CIF from the region in 2024. This figure nearly doubles the USD 110 billion of 2013. Brazil leads as China's top regional partner, representing 54% of exports to China, followed by Chile (19%) and Peru (14%). Chinese exports to the region increased by 77% during the same period, from USD 84 billion FOB in 2013 to USD 149 billion FOB in 2024. Brazil remains the main destination for Chinese imports, receiving 48% of the total in 2024. In addition, China has secured FTAs with Chile, Ecuador and Peru since 2005, with Colombia currently under consideration.

China is becoming an important source of foreign direct investment in the region, particularly in energy, mining and infrastructure sectors. Peru's Chancay megaport exemplifies this as a majority-owned project by China's state-owned shipping company COSCO. The port, with expected investments of circa USD 3.6 billion, was inaugurated in November 2024. Other recent notable investments include Ganfeng Lithium’s USD 1.8 billion commitment to lithium projects in Argentina and Minerals and Metals Group’s (MMG) USD 500 million acquisition of Anglo American’s nickel assets in Brazil. These investments are aligned with China’s Belt and Road Initiative (BRI), through which the country has signed cooperation agreements with 21 countries in Latin America and the Caribbean.

Over recent years, Brazil has pivoted towards China and BRICS as a counterbalance to US pressure. The strategic realignment predates the 2025 tariffs but has accelerated in response to them. This is evidenced by increased diplomatic engagement throughout the year. In recent months, Brazil has echoed the Chinese proposal of a "Global Governance Initiative (GGI)", a possible embryo of a new world order, and called for enhanced trade and financial integration with China and BRICS.

Strategic Implications for US-South American Relations

The region’s strategic importance to the US in geography and natural resources creates a mutual dependency that transcends temporary trade tensions. However, the region has developed economic resilience, including through diversified partnerships. The United States is no longer the primary trading partner for many South American countries. The data reveals a structural shift, with China now occupying a dominant position. This transformation poses long-term strategic challenges for US influence in the region.

The US needs to rethink its trade and diplomatic strategy in response to these changes. Tariff pressures alone risk pushing historically US-aligned nations into Beijing's orbit. More nuanced policy tools may be required to counterbalance China's growing footprint. These could include co-investment, infrastructure finance, sustainability partnerships, and renewed trade initiatives. If the US continues relying heavily on unilateral tariffs without a constructive regional engagement plan, its leverage will continue to wane.

Fiama Angeles is a Senior Trade Policy Analyst at the Global Trade Alert.

Figure 1

Figure 2

Figure 3

Figure 4