What the SCOTUS ruling on IEEPA means for US tariffs

The Supreme Court ruling in Learning Resources v. Trump strikes down IEEPA tariffs, reducing the trade-weighted average US tariff from 15.4% to 8.3%

The Supreme Court ruling in Learning Resources v. Trump strikes down IEEPA tariffs, reducing the trade-weighted average US tariff from 15.4% to 8.3%

Johannes Fritz

20 Feb 2026

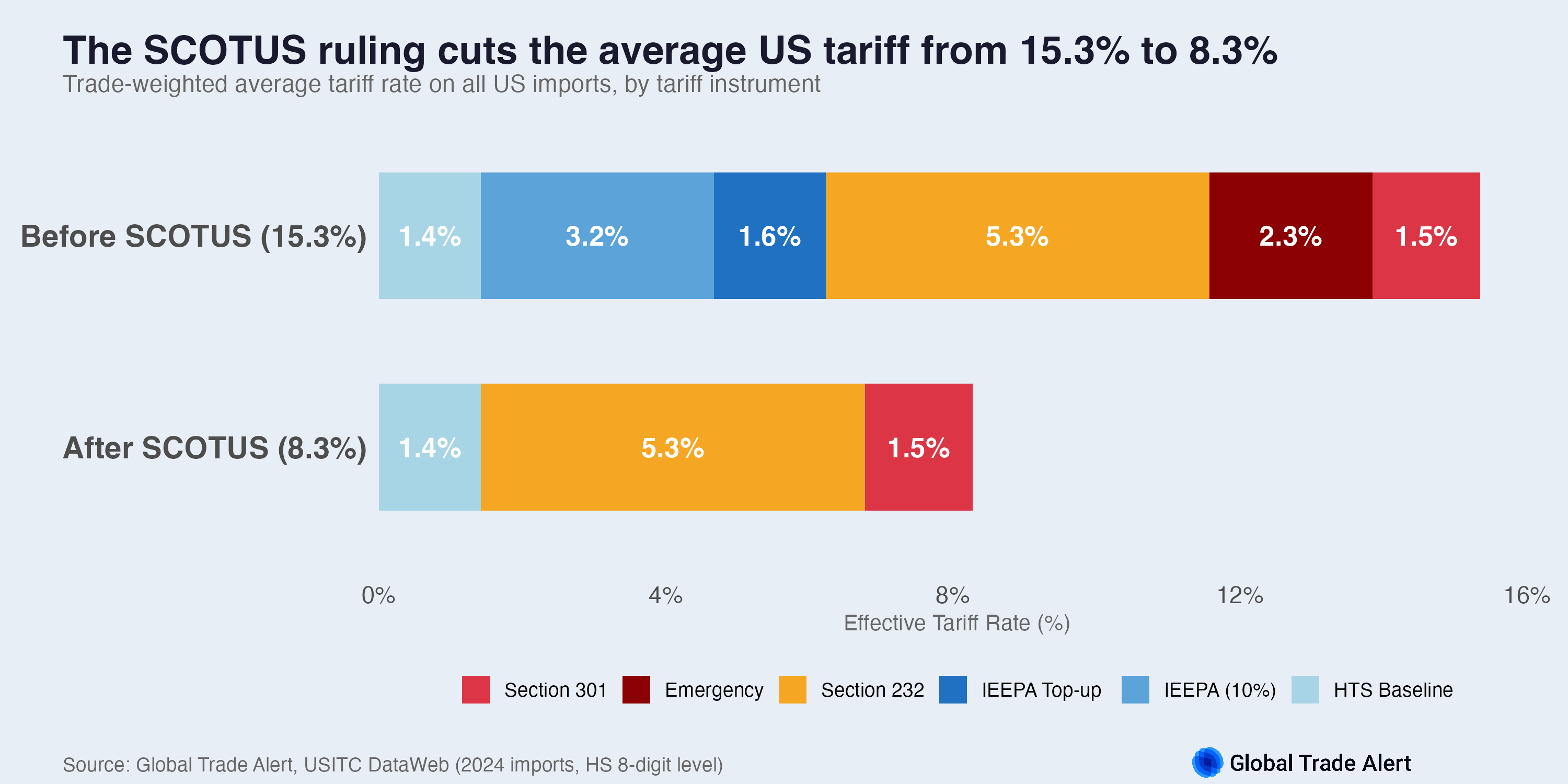

On 20 February 2026, the US Supreme Court ruled in Learning Resources v. Trump that the International Emergency Economic Powers Act (IEEPA) does not authorise the President to impose tariffs. This ruling strikes down the single largest source of tariff increases imposed since January 2025.

The trade-weighted average tariff on all US imports falls by 7.1 percentage points, from 15.4% to 8.3%.

The ruling invalidates all tariffs imposed under IEEPA authority:

The following tariff instruments were imposed under separate legal authorities and are unaffected by the ruling:

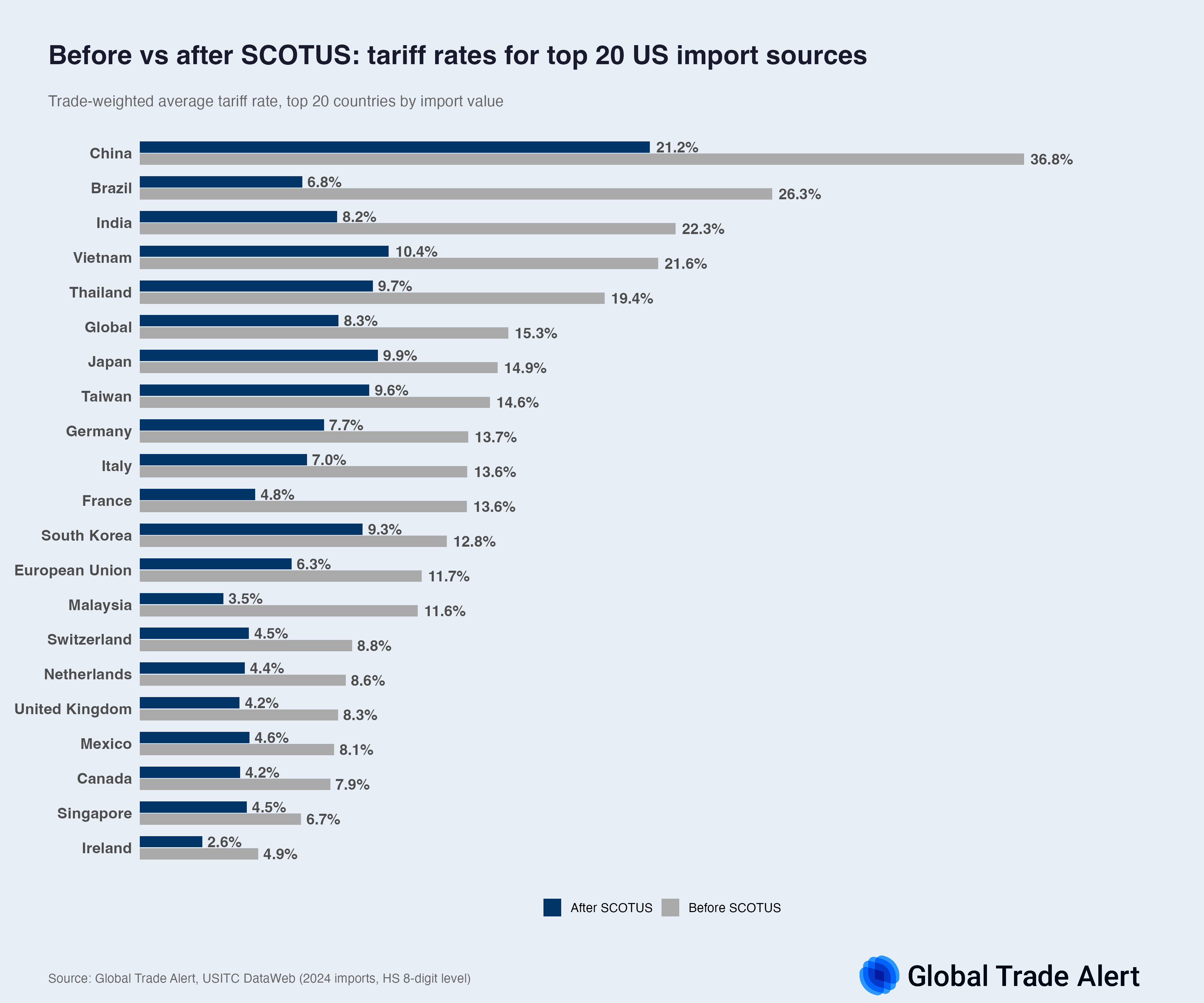

The tariff reduction is visible across all trading partners. The following chart compares before and after rates for the top 20 US import sources.

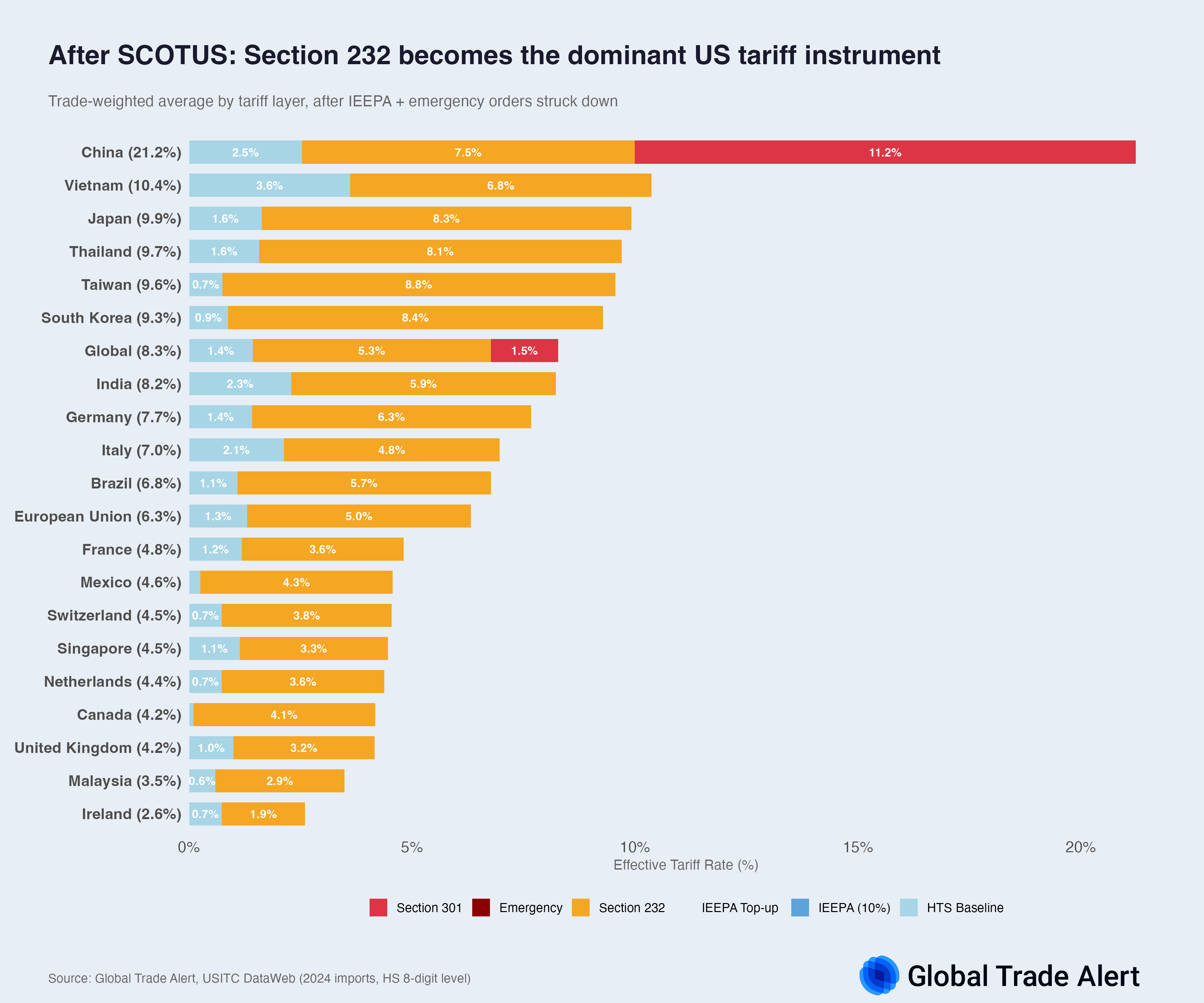

China remains the most heavily tariffed origin due to the remaining Section 301 duties. The chart below shows the post-SCOTUS tariff composition, where Section 232 (orange) has become the dominant instrument for most trading partners.

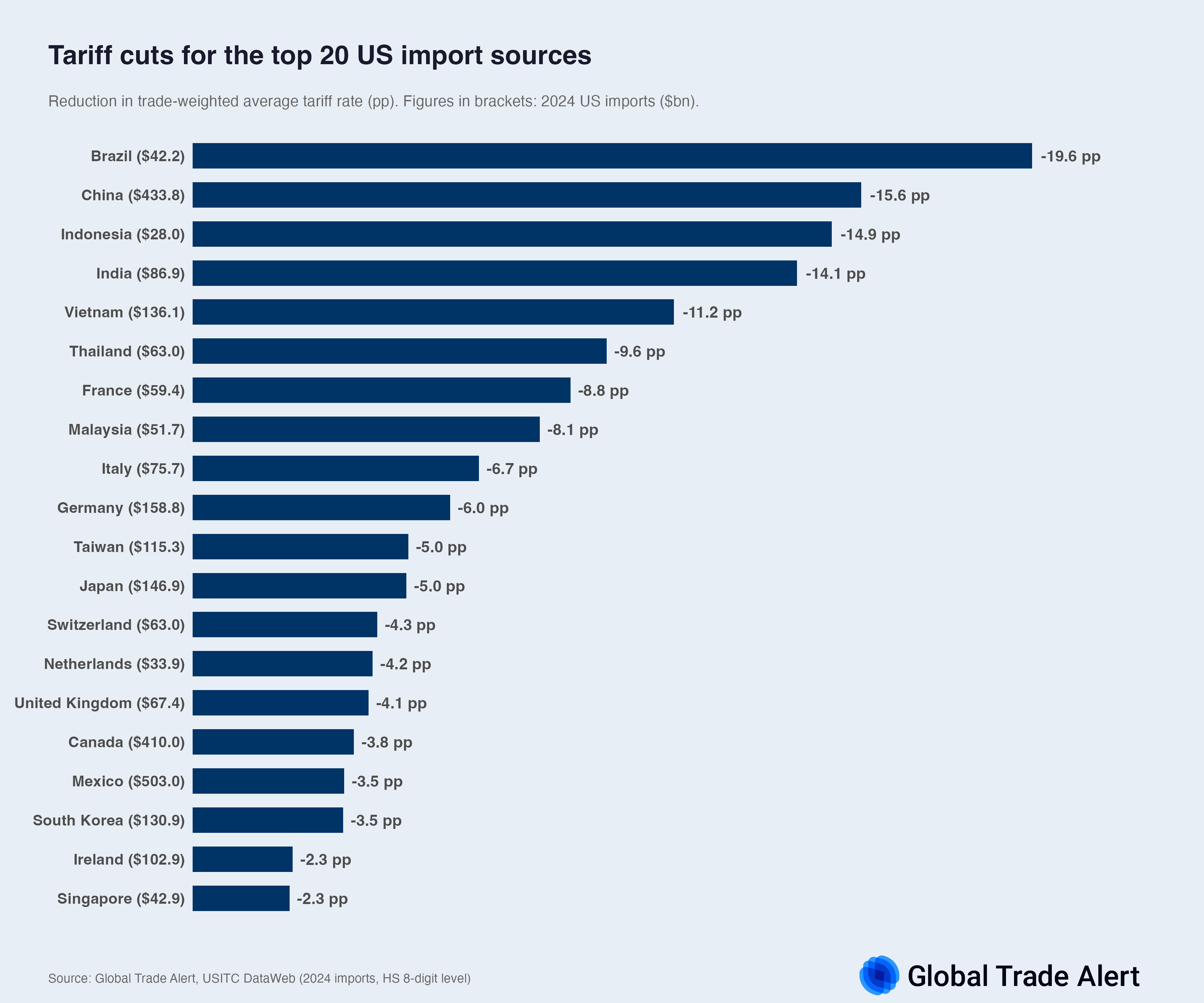

Among the largest US import sources, the tariff cuts range widely. The following chart shows the reduction for the top 20 import origins.

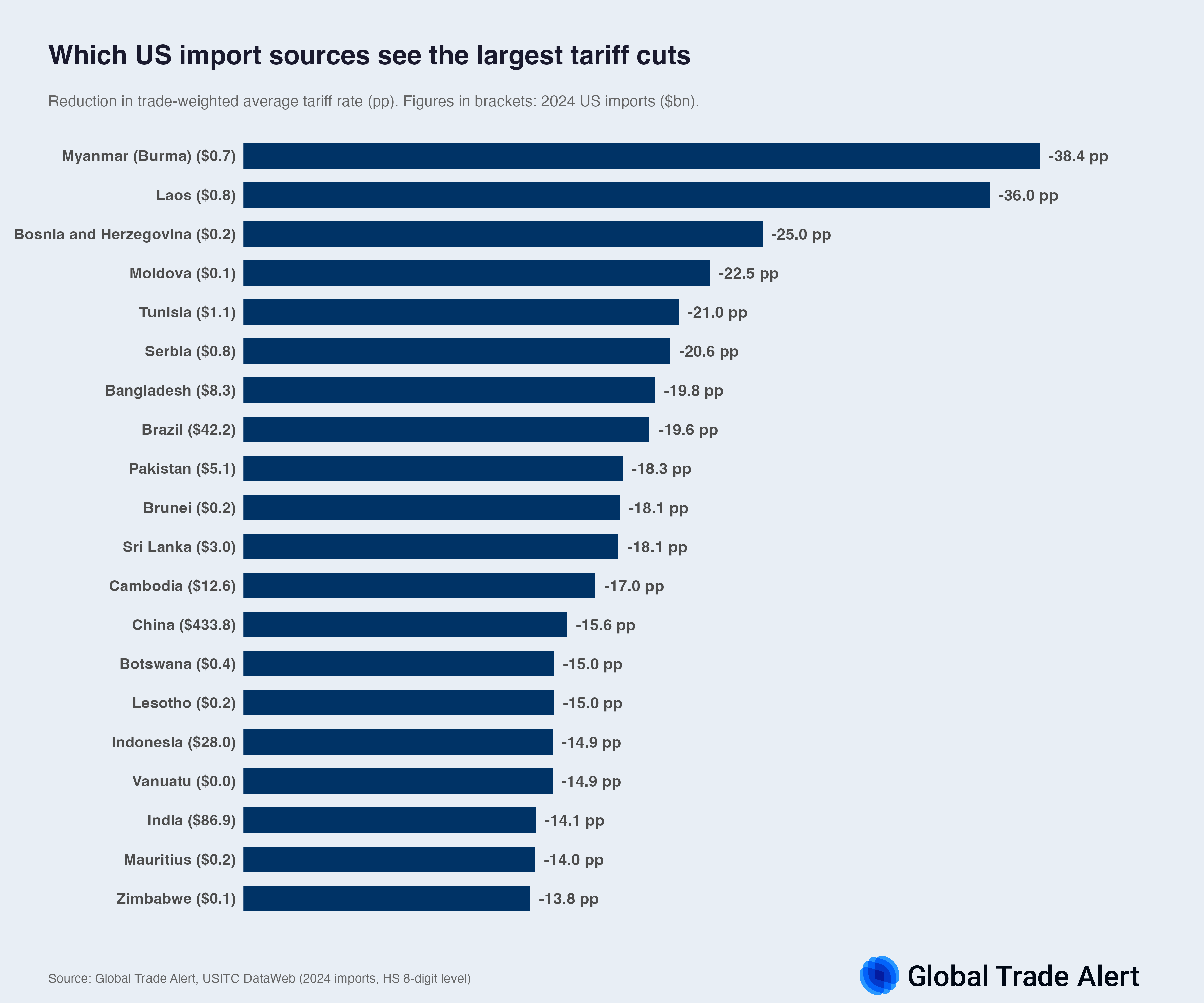

Looking across all trading partners, the largest tariff reductions occur for countries that faced the highest IEEPA top-ups.

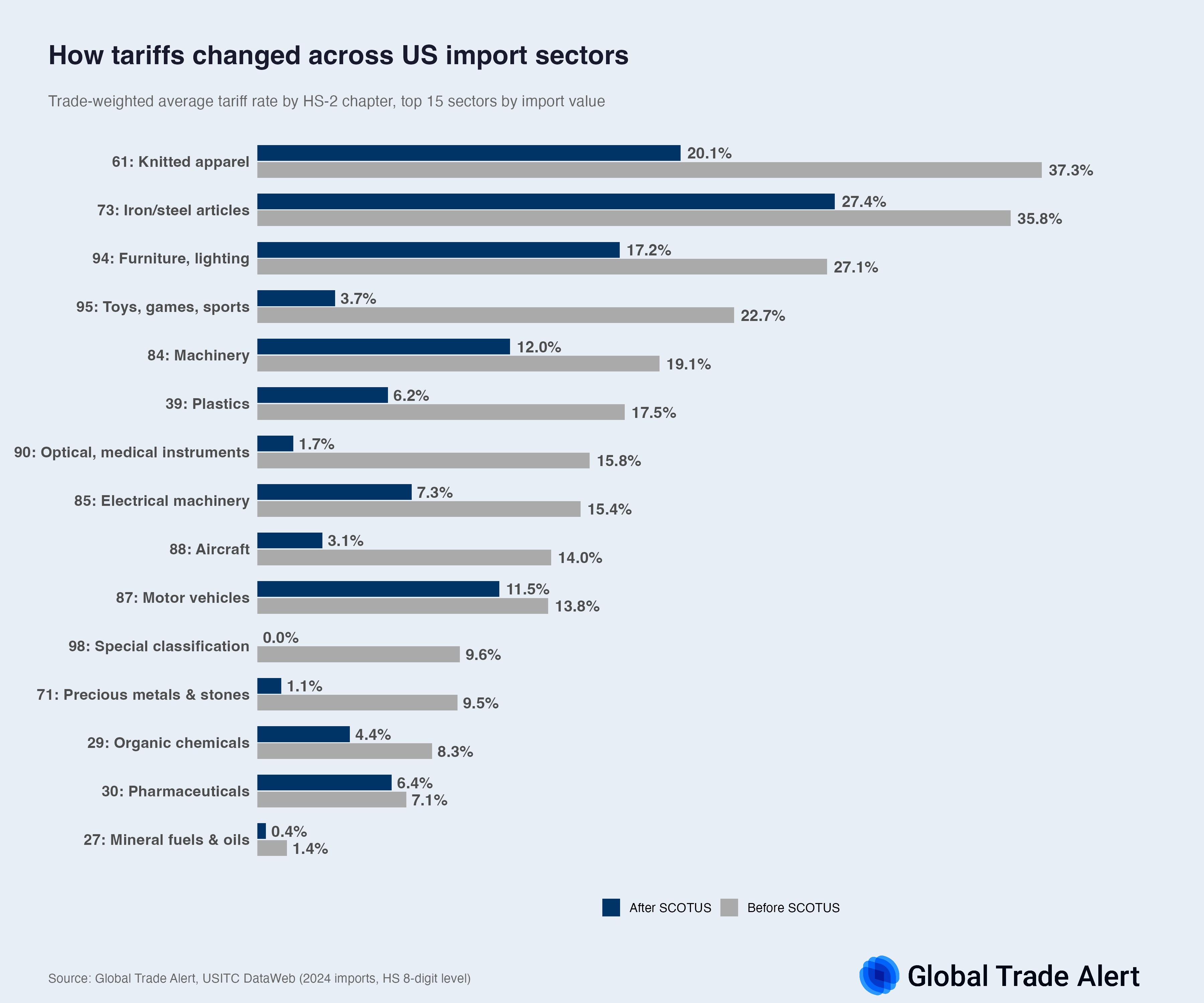

The tariff reduction varies considerably across sectors. Industries dominated by Section 232 products (steel, aluminium, motor vehicles) see smaller reductions, while sectors where IEEPA was the primary tariff instrument see the largest drops.

The following datasets are available for download:

Tariff rates are computed at the HS 8-digit product level for each exporting country and aggregated using 2024 US import values as weights. The analysis covers all US merchandise imports.

The IEEPA full strike-down scenario sets all IEEPA-authorised tariff rates (baseline, top-ups, and floors) and emergency executive order rates to zero, while preserving all other tariff instruments at their current levels.

For the full methodology, see the US Tariff Barrier Estimates documentation.