Section 122 in effect: the US tariff average is now 13.2%

The Supreme Court struck down IEEPA tariffs on 20 February 2026. Within hours, the White House invoked Section 122 of the Trade Act of 1974. The proclamation imposed a flat 10% surcharge on most US imports, effective 24 February 2026, for 150 days. On 22 February, the surcharge was raised from 10% to 15%.

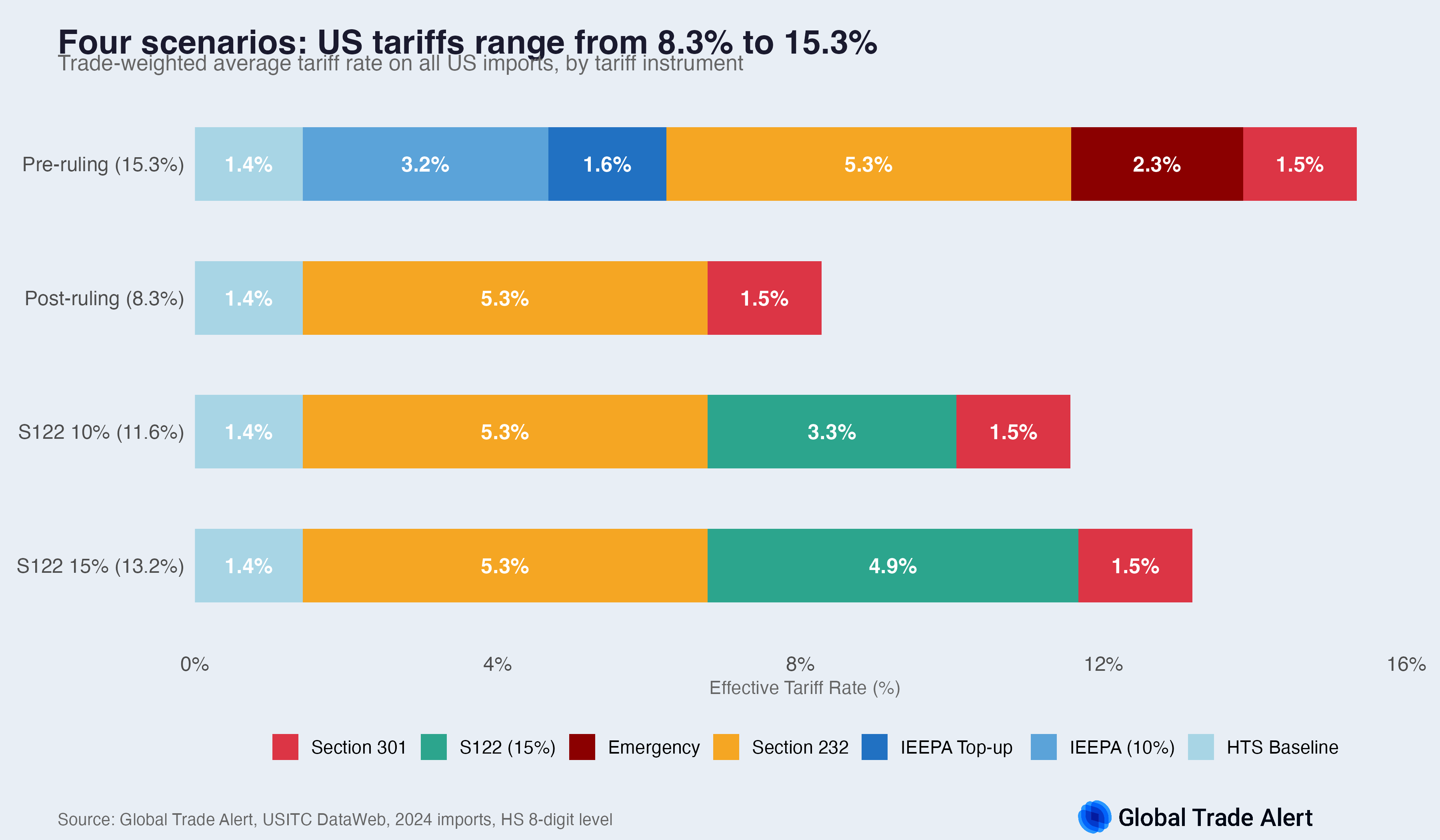

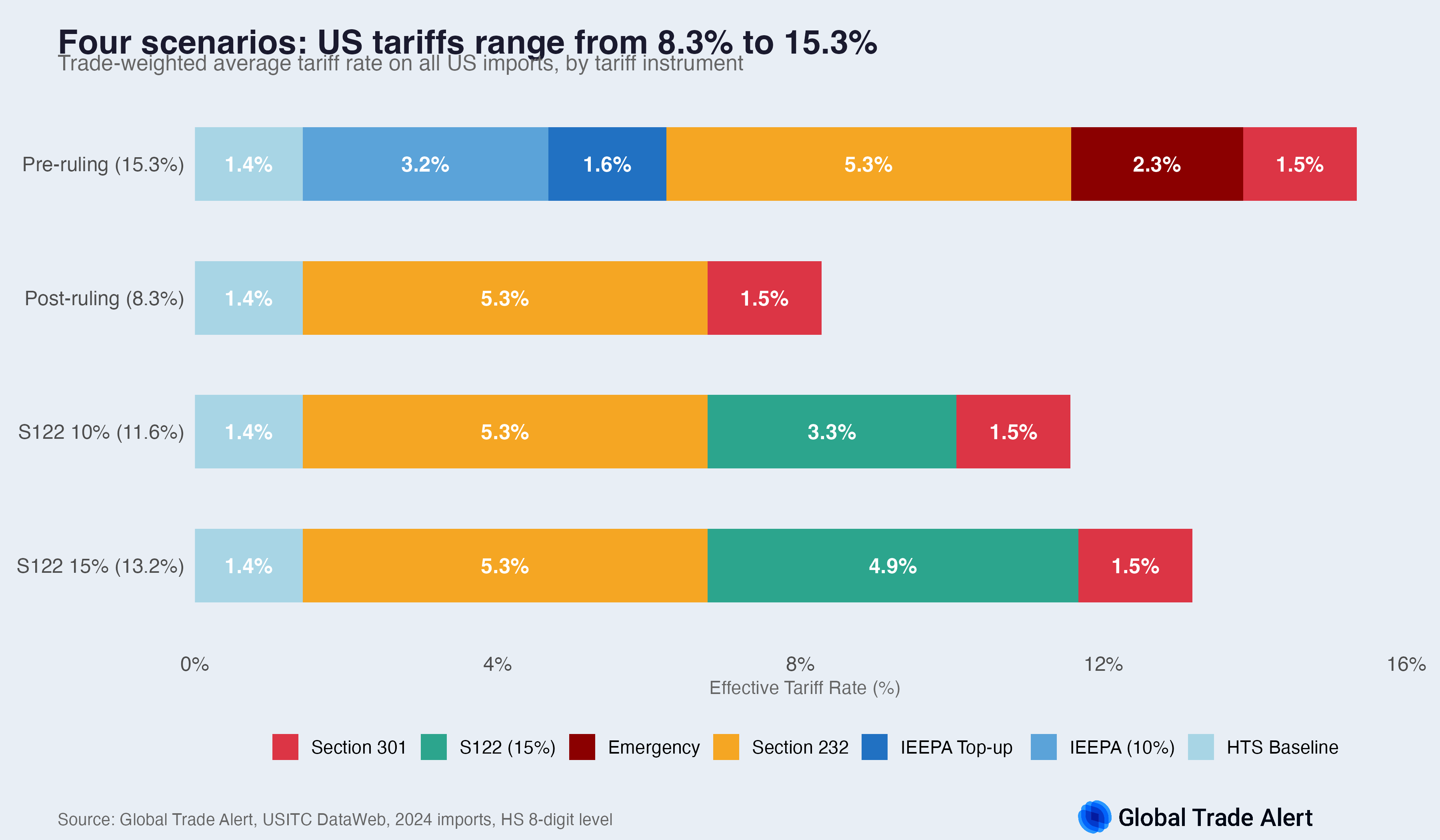

The trade-weighted average US tariff rate under the Section 122 regime at 15% is 13.2%, compared with 11.6% at 10%, 15.3% before the ruling, and 8.3% if no replacement had been enacted.

What the proclamation does

The Section 122 proclamation imposes a flat surcharge on all imports (initially 10 percentage points, raised to 15 on 22 February), with the following exceptions:

- Section 232 primacy: Products already subject to Section 232 tariffs (steel, aluminium, copper, lumber, automobiles) are excluded from the surcharge to the extent the 232 tariff applies.

- USMCA preferences: Articles entering duty-free under USMCA remain exempt.

- CAFTA-DR textiles: Textile and apparel articles entering duty-free under the Dominican Republic-Central America Free Trade Agreement are exempt.

- Annex II exceptions: Approximately 1,100 product codes are exempted from the surcharge.

The surcharge is explicitly temporary: 150 days from 24 February 2026, expiring 24 July 2026 unless Congress extends it. For a detailed analysis of the proclamation, including the exception list changes and the fate of bilateral trade deals, see our Section 122 explainer.

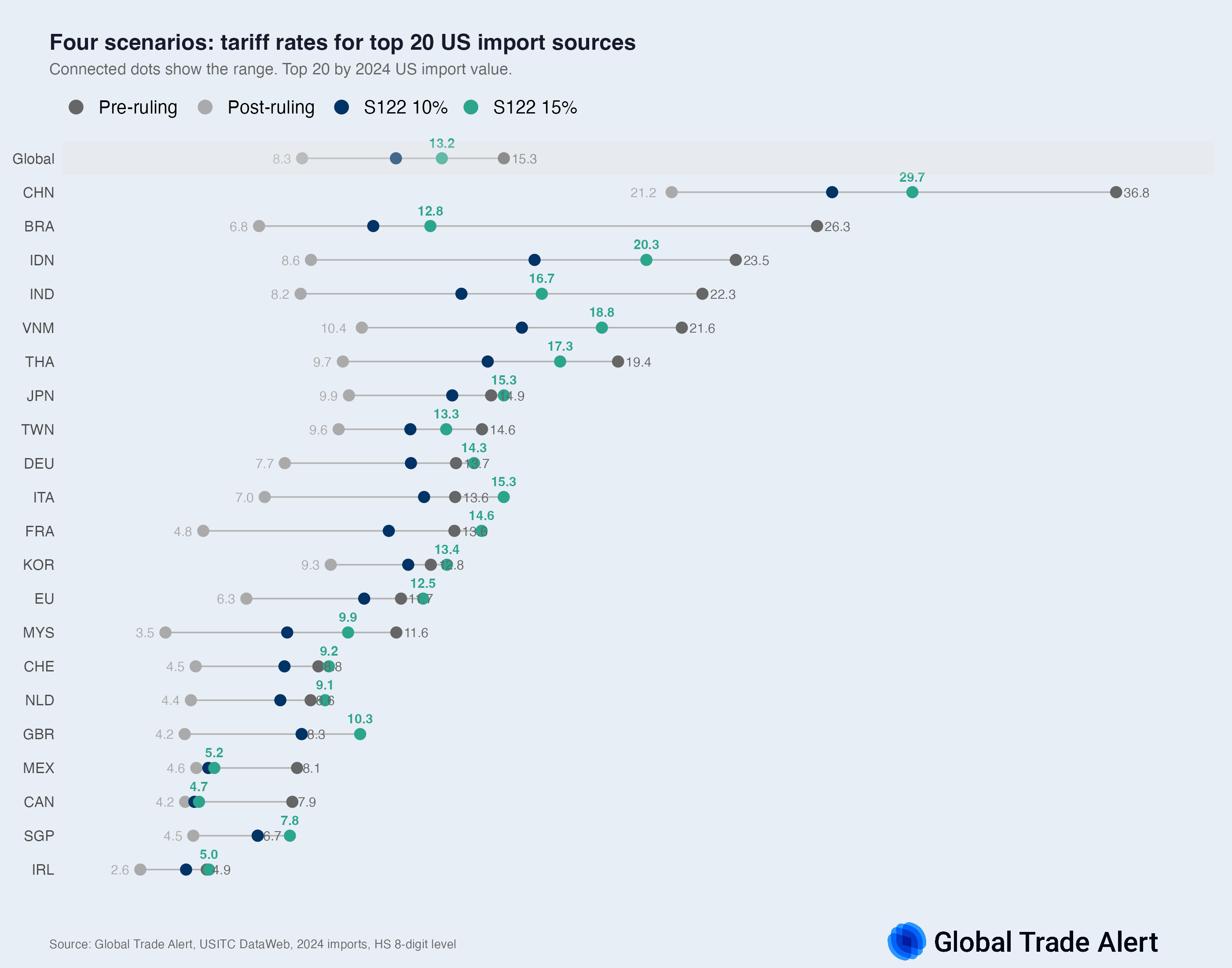

By country: top 20 import sources

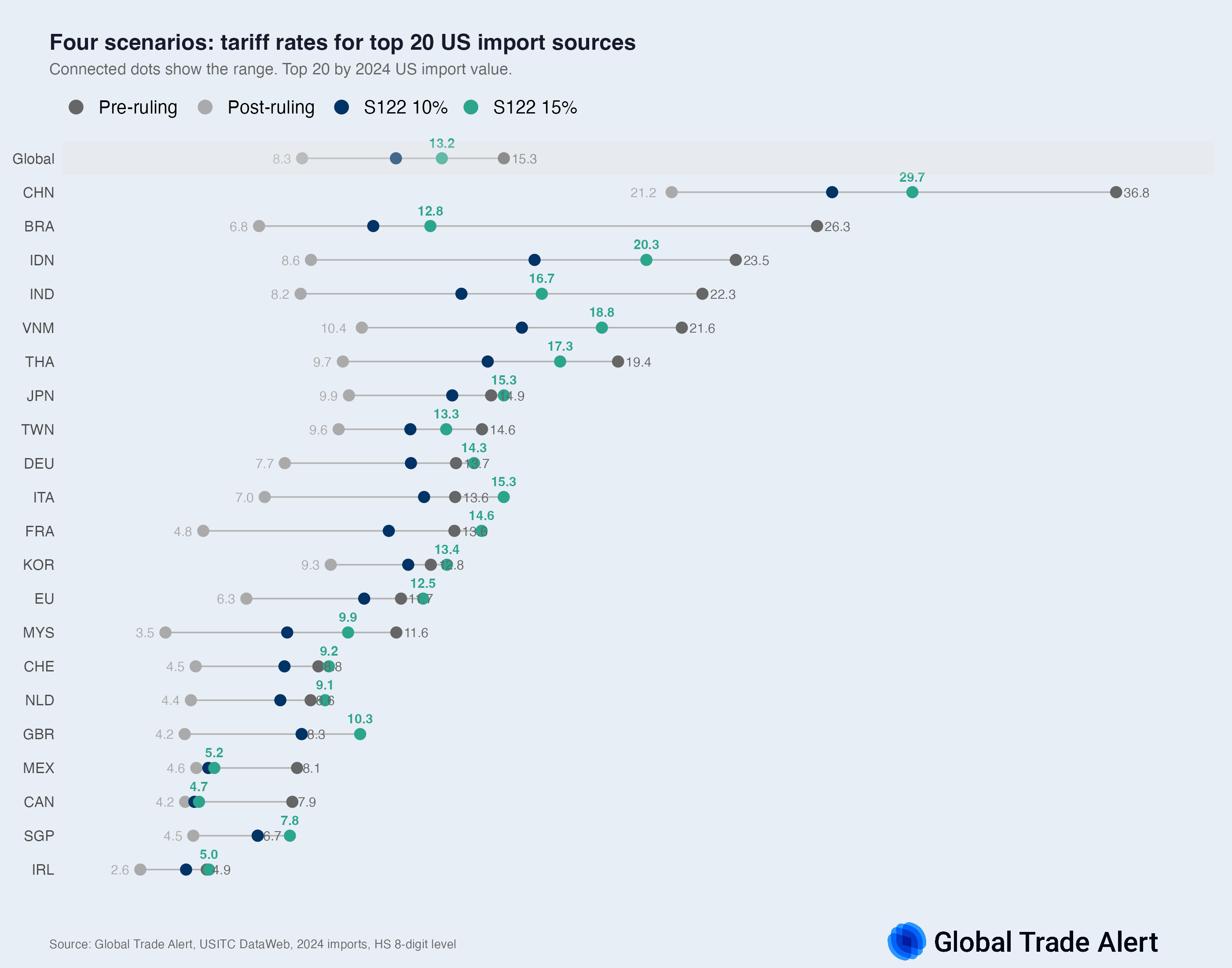

The following chart compares all four scenarios for the top 20 US import sources. The dark grey dots show the pre-ruling tariff rate, the light grey dots show what remains after IEEPA is struck down, the navy dots show S122 at 10%, and the teal dots show S122 at 15%.

Countries that faced high IEEPA rates (India, Thailand, Vietnam) see substantially lower tariffs under the Section 122 replacement than they did before the ruling. Countries with low pre-existing tariffs see a more modest change, with the 15% surcharge providing the floor.

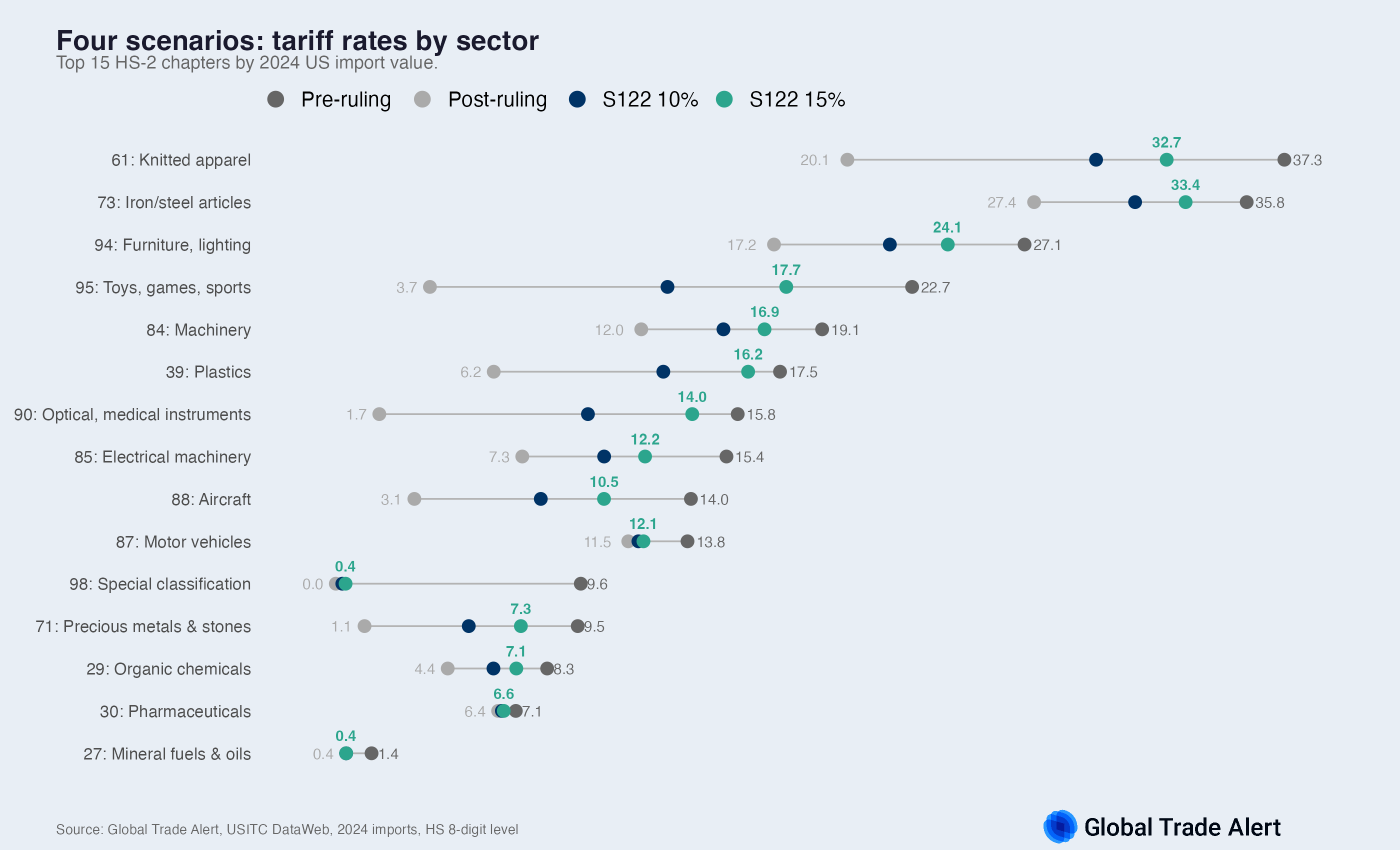

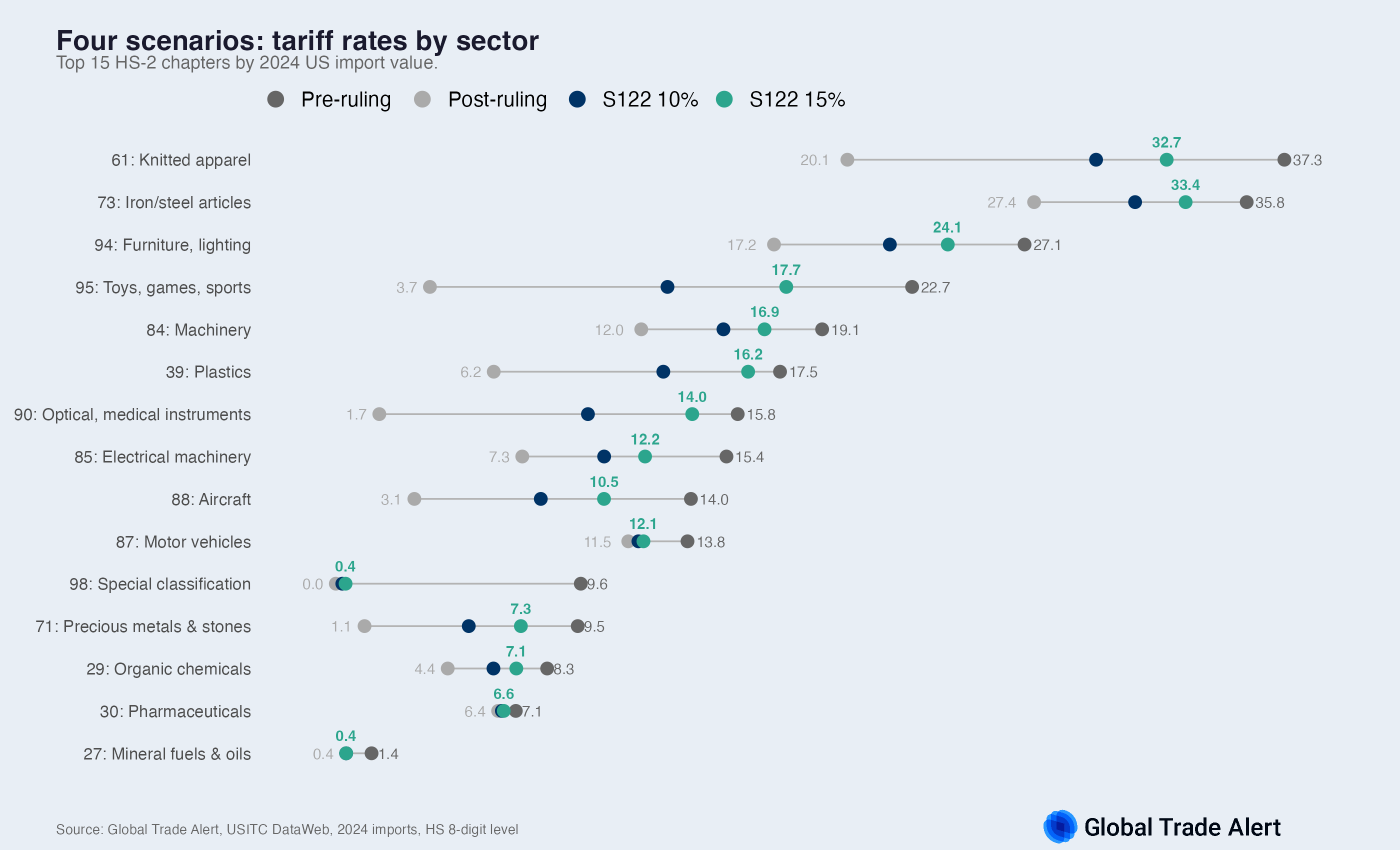

By sector: HS-2 chapters

The sector-level view reveals where the Section 122 regime differs from the pre-ruling tariff stack. Industries dominated by Section 232 products (iron and steel, aluminium) show less movement because the surcharge does not apply where 232 tariffs already bite. Sectors where IEEPA was the primary tariff instrument show the largest gaps.

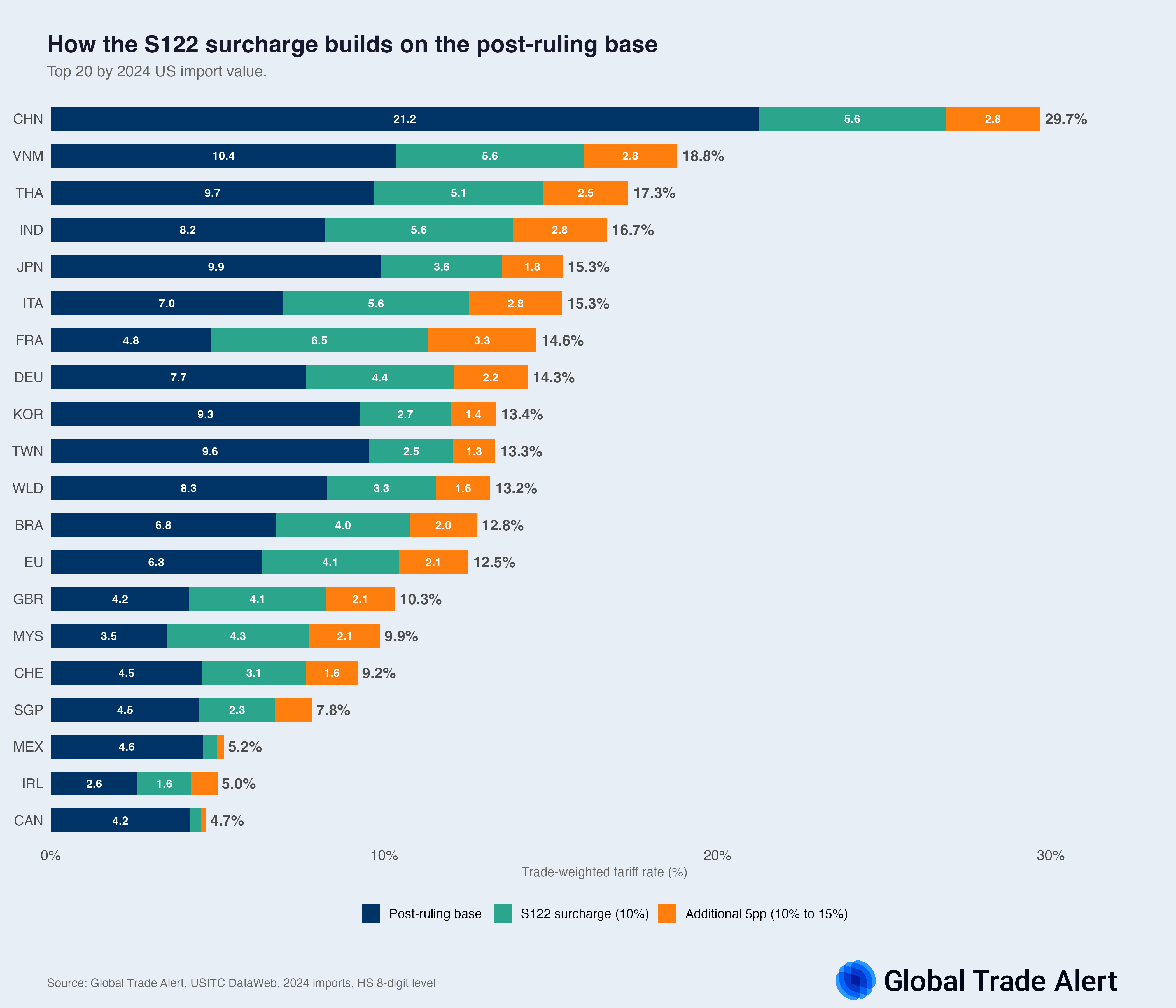

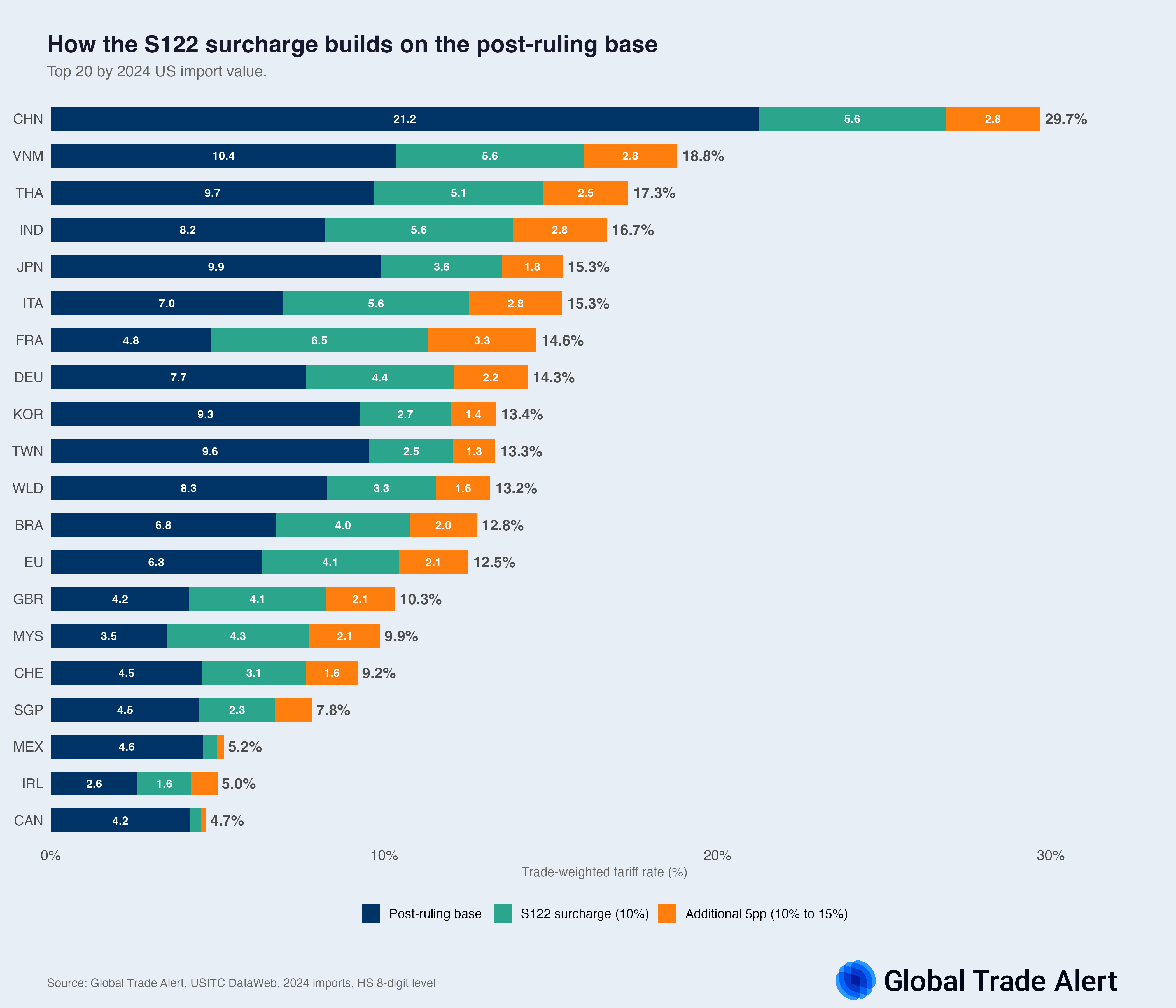

S122 contribution decomposition

The following chart decomposes the Section 122 tariff regime into three layers for each of the top 20 import sources: the post-ruling base rate (tariffs that survived the SCOTUS decision), the S122 surcharge at 10%, and the additional 5 percentage points from the increase to 15%.

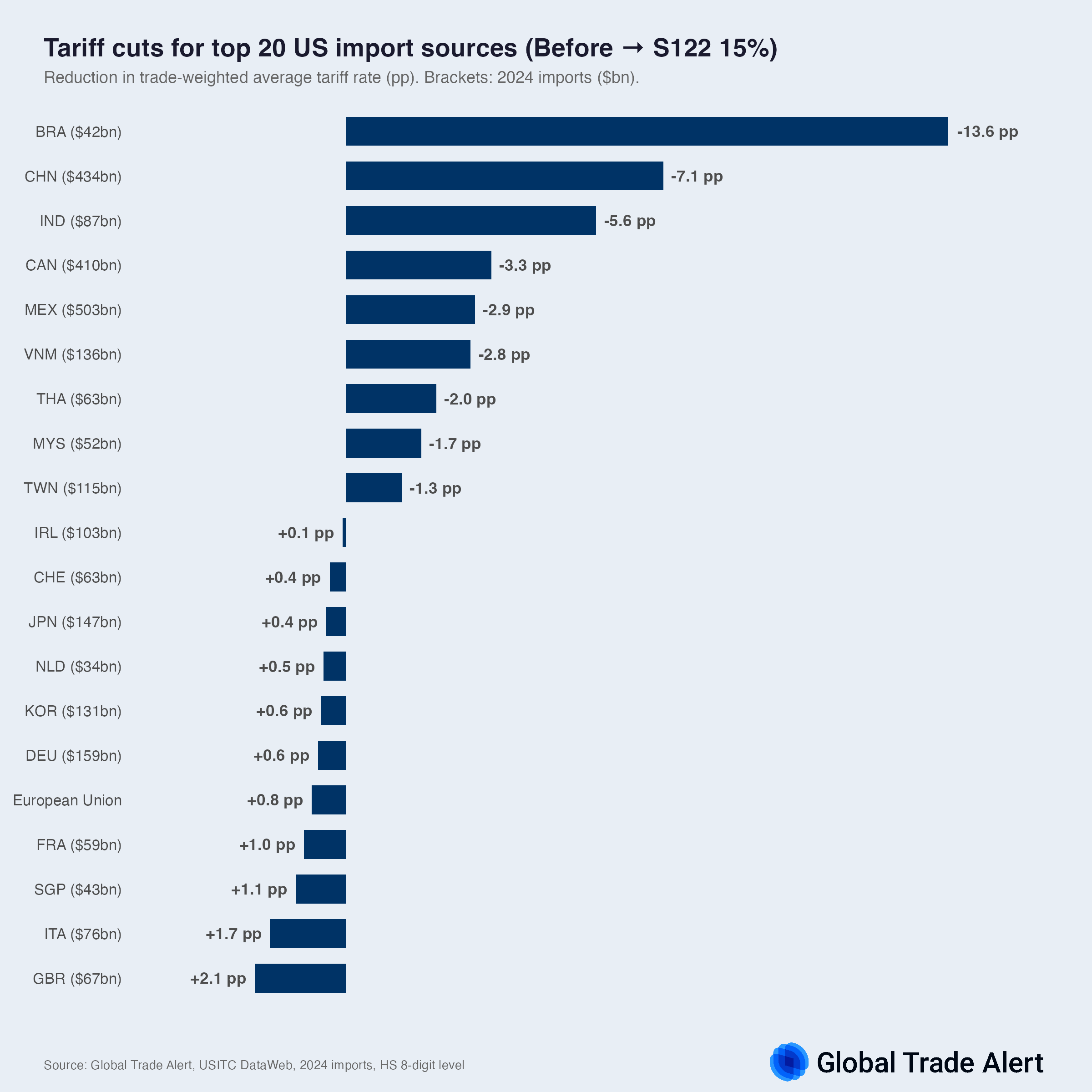

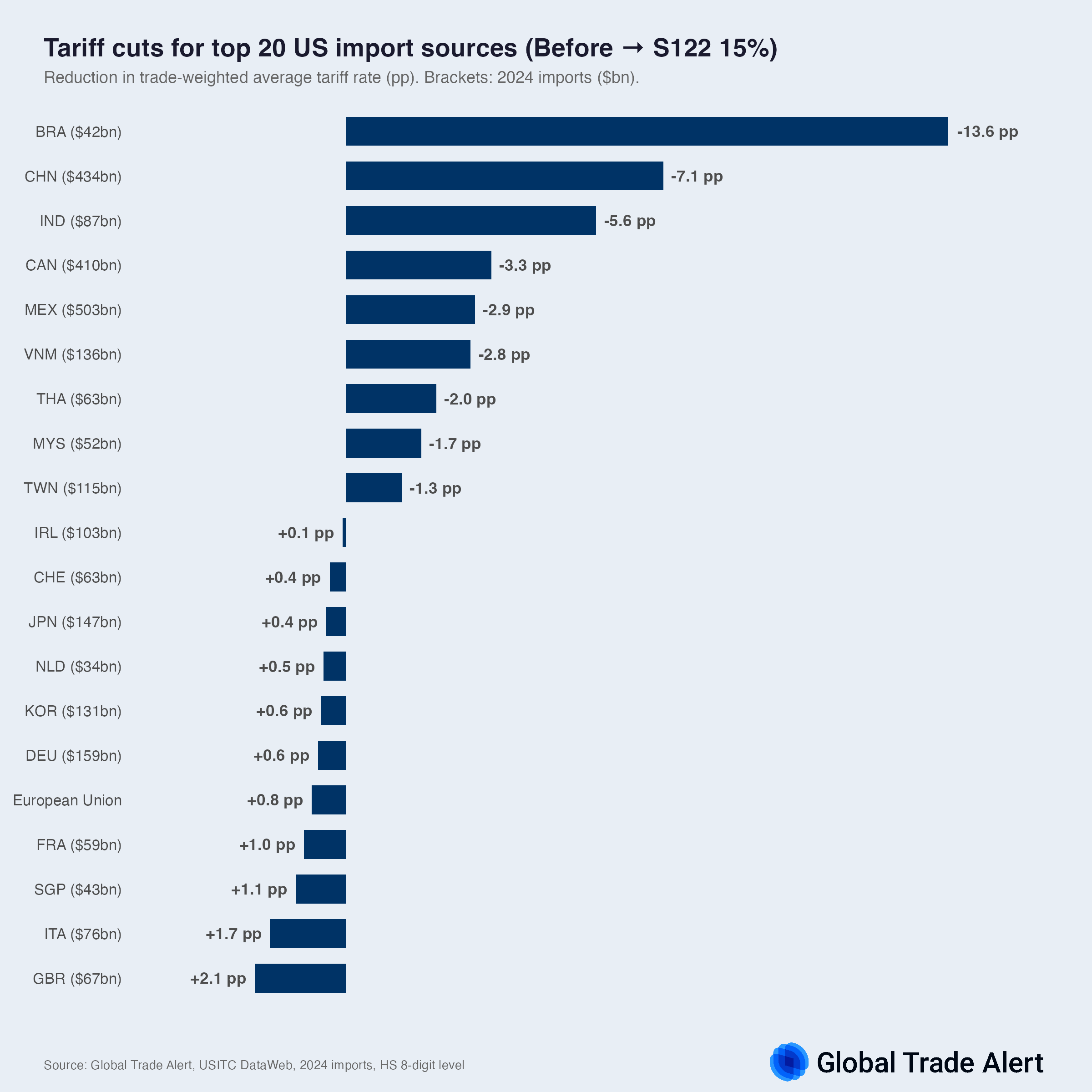

Winners and losers: tariff cuts by country

The shift from the pre-ruling tariff regime to Section 122 at 15% produces clear winners and losers among the top 20 US import sources. Countries that faced steep IEEPA surcharges see large tariff reductions: Brazil (-13.6 pp), China (-7.1 pp), and India (-5.6 pp) benefit most, since the flat S122 surcharge replaces country-specific IEEPA rates that were far higher.

At the other end, countries that already faced low tariffs before the ruling now pay more. The United Kingdom (+2.1 pp), Italy (+1.7 pp), and Singapore (+1.1 pp) see the largest increases, because the 15% S122 surcharge exceeds what they paid under the IEEPA regime.

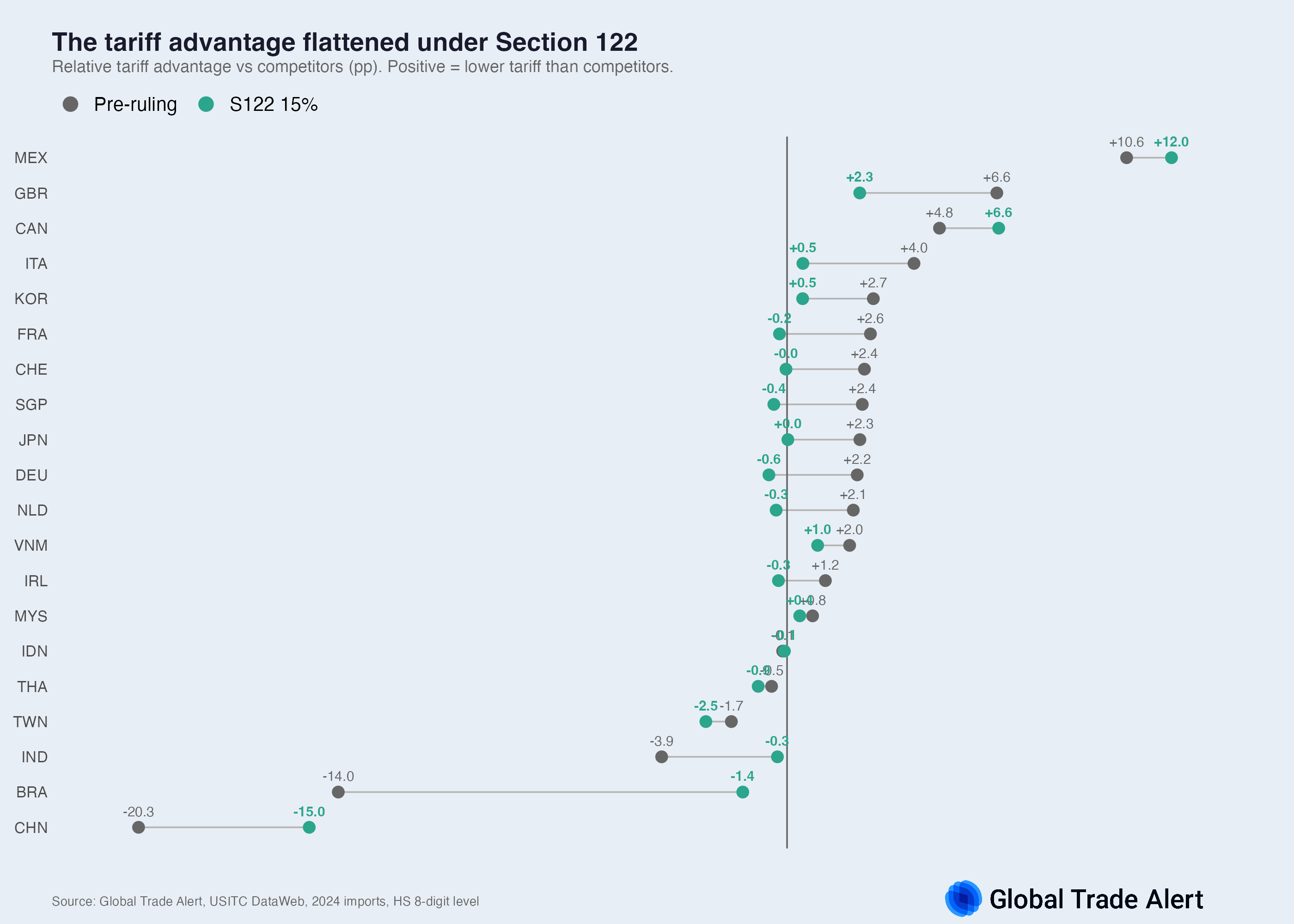

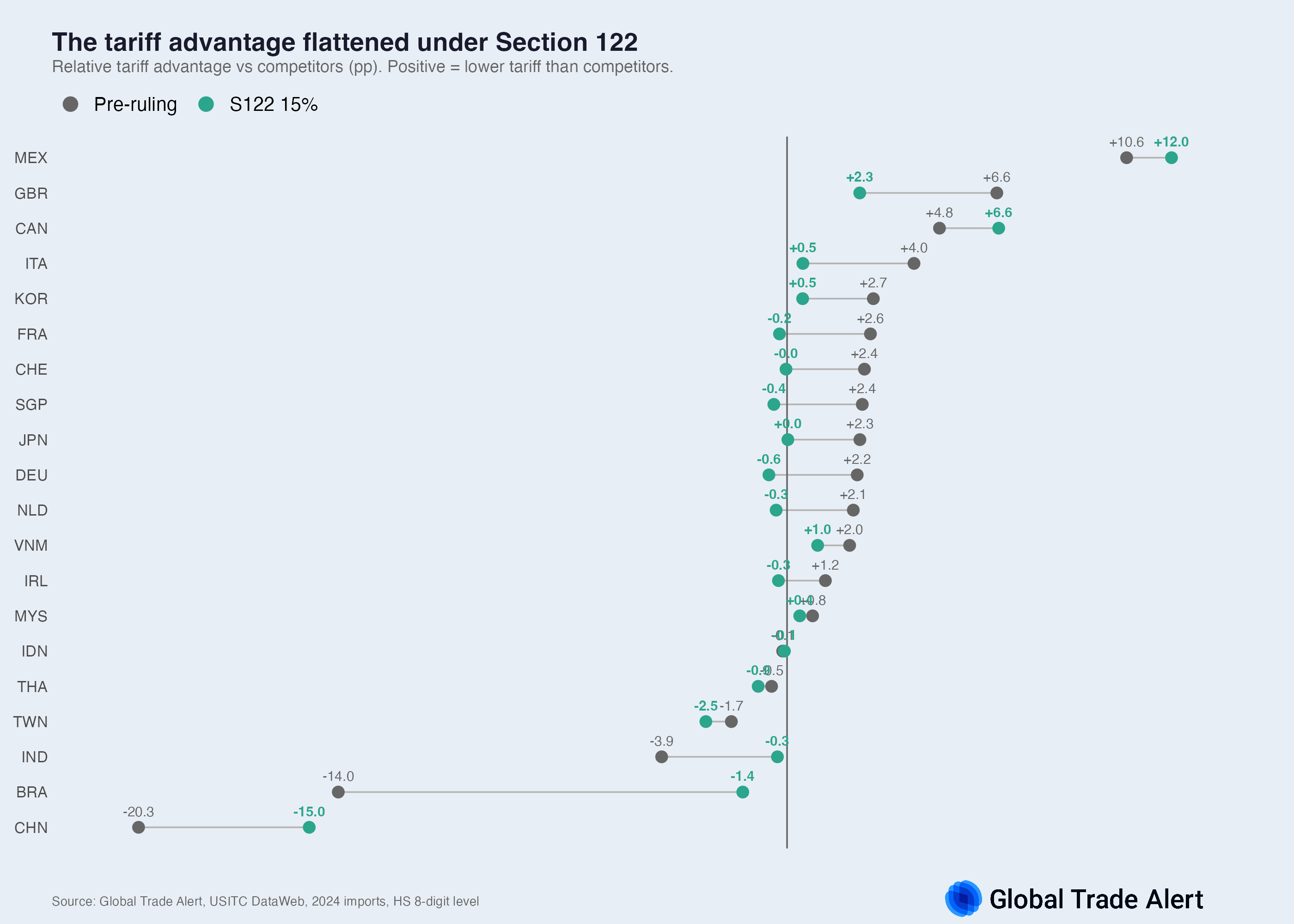

Relative tariff advantage by country

A flat surcharge treats all countries equally in nominal terms, but not in relative terms. The relative tariff advantage measures how much more (or less) a country's imports are taxed compared with the global average. Countries with a positive value face above-average tariffs; countries with a negative value face below-average tariffs.

Under the pre-ruling regime, the spread was wide: countries like China and India faced tariffs far above the global average, while Canada, Mexico, and most European exporters sat well below it. The Section 122 regime at 15% compresses this spread significantly. Because the surcharge is flat, country-specific variation shrinks. China still faces the highest relative tariff burden, but the gap has narrowed. Countries that were lightly taxed before now sit closer to the average.

Downloads

The following datasets are available for download:

- Country-level comparison: Tariff rates for all US import sources under all four scenarios, including EU aggregate and HS-2 sector breakdown

- Flow-level public dataset: Complete tariff rates at the exporter x HS 8-digit product level for all scenarios (274,000+ flows)

Methodology

Tariff rates are computed at the HS 8-digit product level for each exporting country and aggregated using 2024 US import values as weights. The analysis covers all US merchandise imports.

Four reference points are modelled:

- Before SCOTUS: The tariff regime as of 19 February 2026, including all IEEPA, S232, S301, and emergency tariffs.

- IEEPA Strike Down: All IEEPA-authorised tariffs and emergency orders removed following the Supreme Court ruling on 20 February 2026.

- Post-SCOTUS + S122 at 10%: The tariff regime under the initial Section 122 proclamation with a 10% surcharge, with exceptions for S232, USMCA, CAFTA-DR, and Annex II products.

- Post-SCOTUS + S122 at 15%: The current tariff regime effective 24 February 2026, after the surcharge was raised to 15% on 22 February.