Decoding the Dirty 15: What the 2020 NTE Report Reveals About the Coming Wave of U.S. Tariffs

ZEITGEIST SERIES BRIEFING #58

ZEITGEIST SERIES BRIEFING #58

In a return to form, the Trump Administration is preparing a new tariff package aimed at roughly 15 trading partners with “persistent trade imbalances and egregious non-tariff barriers” to U.S. exports. Targeting the “Dirty 15,” as Treasury Secretary Scott Bessent labelled them, represents a pivot toward weaponizing trade policy under a nationalistic, reciprocity-based framing. While the economies on this list remain undisclosed, the contours of U.S. trade grievances are not.

This analysis revisits the 2020 National Trade Estimate (NTE) Report, a cornerstone document of President Trump’s first-term trade strategy1. More than just a survey of trade friction, the report amounts to a declaration of strategic intent. It did not merely list problems; it amplified them using language that transformed regulatory misalignment into national security threats.

This piece leverages an advanced language model to analyse tone, barrier frequency, and sectoral patterns across the top U.S. trade partners—with a focus on the 15 countries with the largest goods trade deficits with the United States plus and the UK2.

Later NTE reports during the Biden Administration were organised differently and offer little guide to the likely course of current U.S. trade policy.

The 2020 NTE Report was uploaded to ChatGPT-4o, and I asked it to identify the key sectors, major trade barriers, and overall tone regarding the United States’ main trading partners.

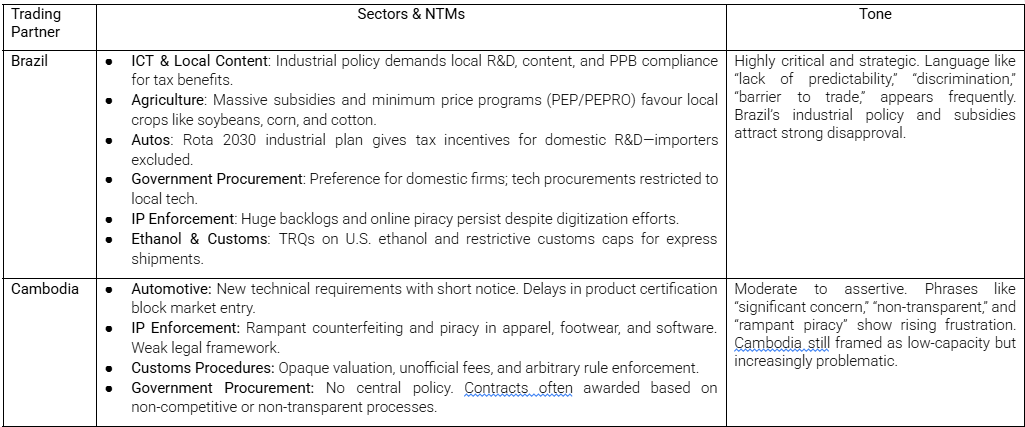

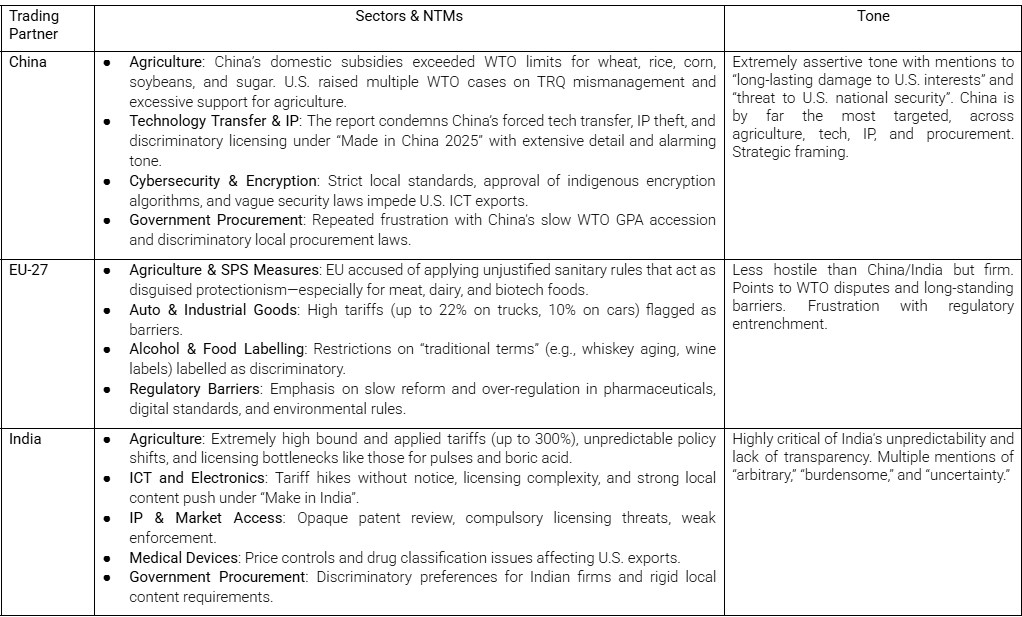

The 2020 NTE report was among the most assertively framed in USTR history. Countries like China, India, Brazil, and Indonesia were portrayed as deploying non—tariff measures (NTMs) in a systematic, strategic fashion to favour domestic industries while holding back U.S. exports. Terms like “discriminatory,” “burdensome,” and “inconsistent with WTO obligations” abound. Aggressive language signalled that retaliation by the United States was not merely reactive but punitive.

Notably, the report frequently invoked NTMs as weapons—tools used to achieve unfair competitive advantage in strategic sectors like ICT, biotech, autos, and digital trade. The use of industrial policy, localisation mandates, and restrictive licensing regimes were especially scrutinised. In a second Trump term, these patterns are likely to reappear as justifications for new punitive measures.

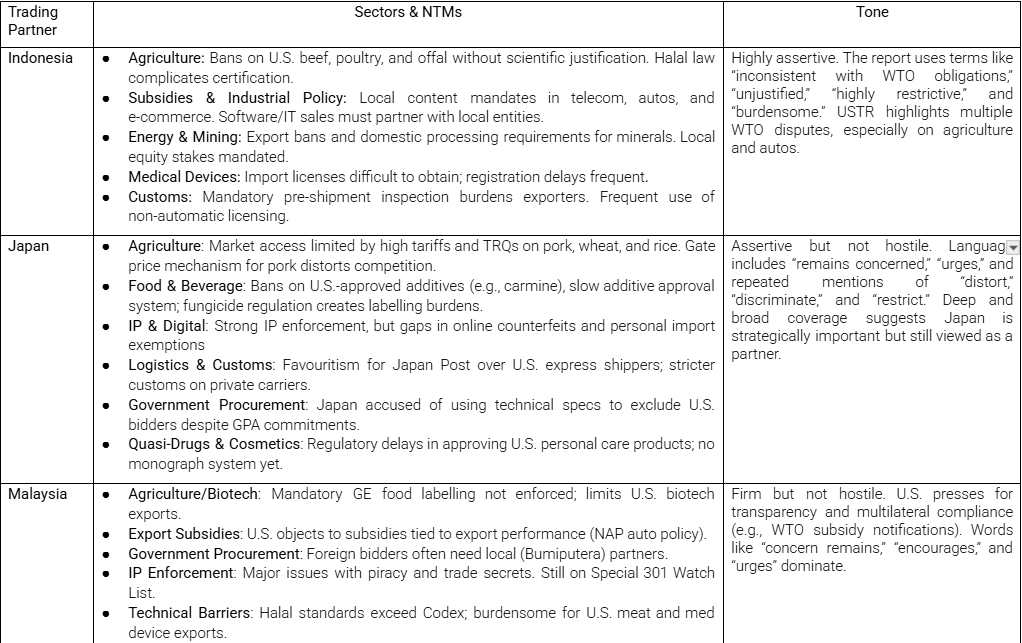

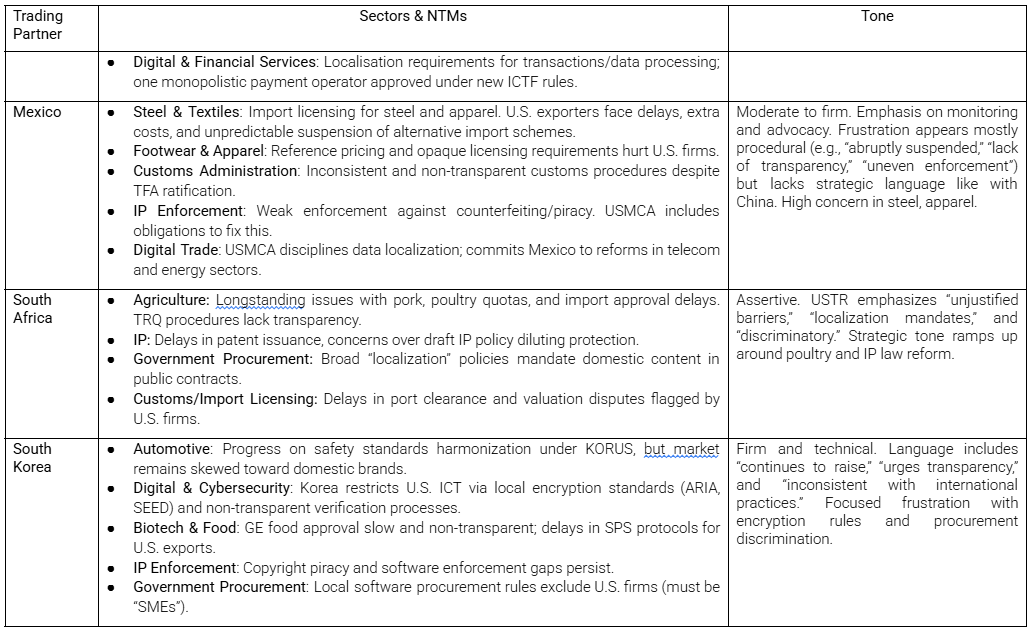

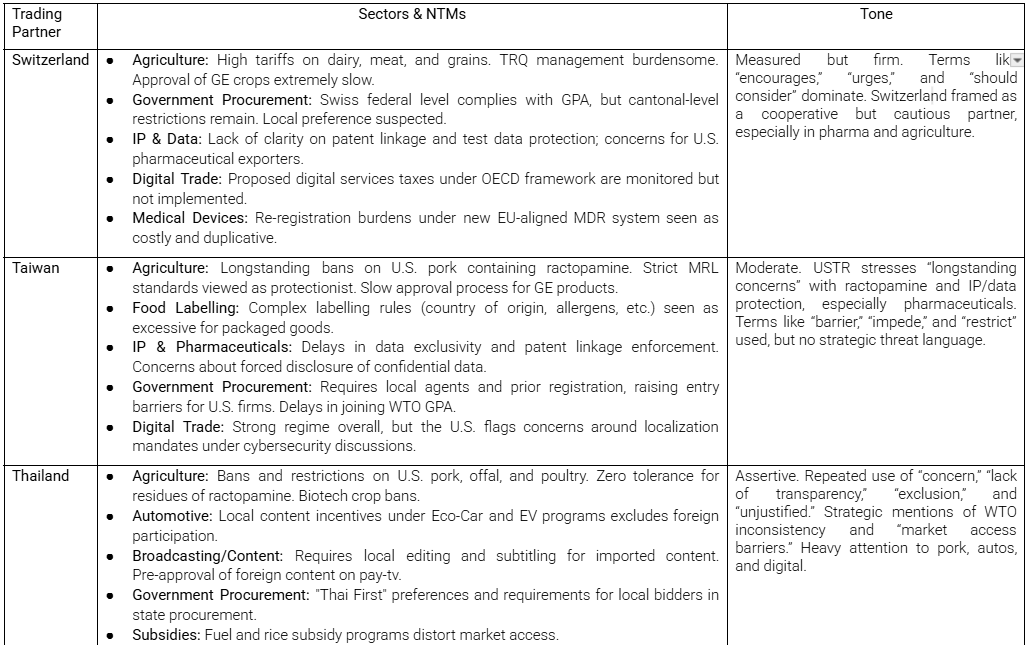

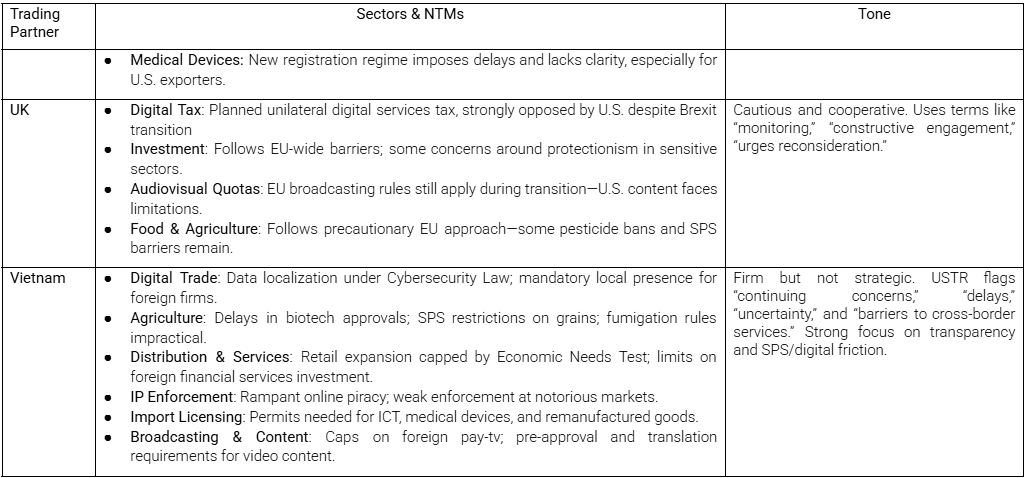

A review of the 2020 report across major trading partners provides clear indications of where tensions were most acute:

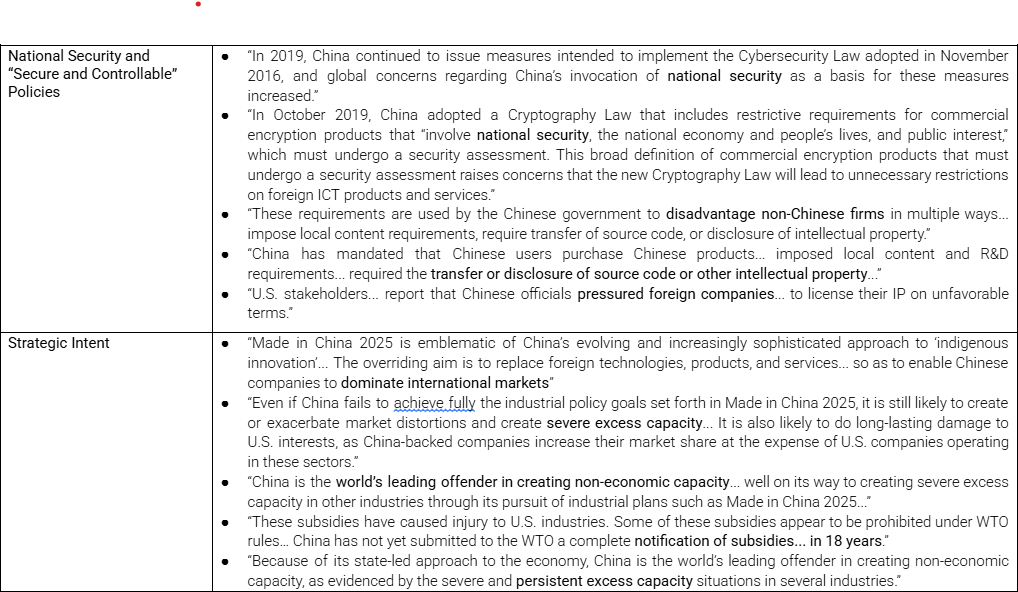

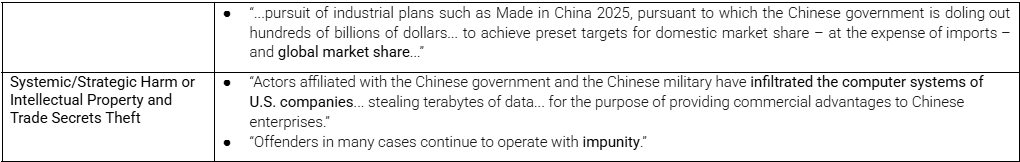

China was the most aggressively targeted, particularly for its state-driven economic model, industrial policies, forced tech transfer, and IP practices under “Made in China 2025.” Language like “dominate international markets”, “secure and controllable”, “massive excess capacity”, “state-led approach”, “not on market terms”, “threat to U.S. national security” or “unprecedented state intervention” was used in several parts of the report. See Table 1 for specific examples.

India, Brazil, and Indonesia were flagged for opaque licensing, excessive tariffs, and aggressive localisation. All three face highly critical language that frames their policies as not just trade barriers but strategic threats to U.S. firms.

The EU and Japan were treated with more nuance. While the tone was firm, the strategic intent claimed of the large emerging markets was not repeated. Nevertheless, sectors like agriculture, digital services, and pharmaceuticals were hotspots then and now.

Smaller economies like Vietnam, Malaysia, and Thailand were critiqued for, among others, digital restrictions and opaque customs rules. Though not framed as strategic threats, these issues could be elevated in a renewed America First trade doctrine that links digital sovereignty to economic coercion.

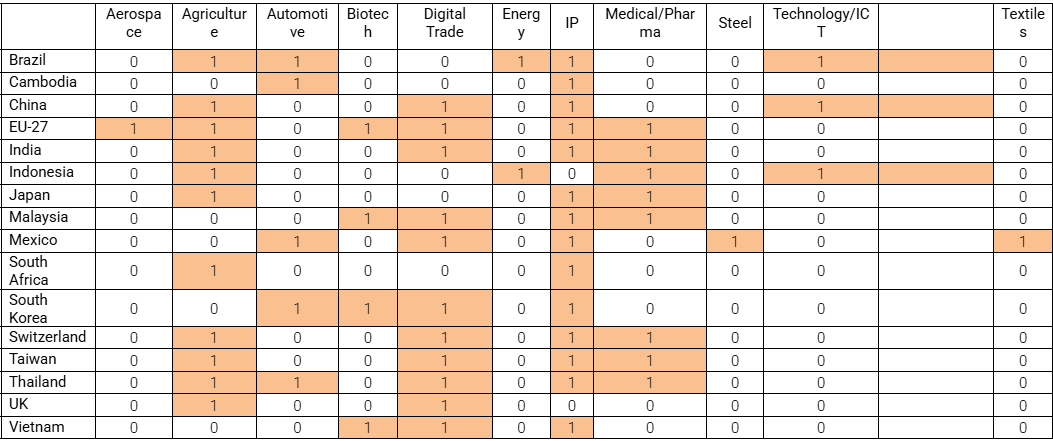

Analysis of the 2020 NTE report’s most frequently mentioned sectors reveals a strategic map of potential tariff targets:

Agriculture stands out across nearly all countries, often entangled with SPS (sanitary and phytosanitary) measures framed as disguised protectionism.

ICT and digital trade, including localisation mandates, cybersecurity laws, and discriminatory tech standards, were mentioned in the chapters on China, India, South Korea, Vietnam, and others. These are ripe for countermeasures under a tech-sovereignty rubric.

Autos and industrial goods, especially in Brazil, Mexico, and Thailand, are frequent flashpoints where local content rules and industrial plans limit U.S. participation.

Medical and pharmaceutical exports are also repeatedly cited, particularly for burdensome approvals and price controls in Japan, India, Malaysia, and Switzerland.

This sectoral lens, when cross-referenced with tone and strategic framing, helps isolate where the Trump administration may impose in the future targeted tariffs beyond broad country-level measures.

Perhaps most revealing, the 2020 report doesn’t treat NTMs as mere trade irritants. In sectors like 5G, rare earths, and pharmaceuticals, they are framed as strategic tools of economic statecraft. For example, “Through these export restraints, it appears that China is able to provide substantial economic advantages to a wide range of downstream producers in China at the expense of foreign downstream producers, while creating pressure on foreign downstream producers to move their operations, technologies, and jobs to China,” or “China issued a final measure creating an expedited approval process for innovative drugs where the applicant’s manufacturing capacity had been shifted to China.”

This suggests that a second Trump administration may apply tariffs not only to balance trade numerically but to counter what it perceives as weaponised protectionism. This aligns with a broader geoeconomic posture in which trade policy is a lever for national security.

The 2020 NTE report is not just a historical artifact—it should be read as a blueprint. Its language, structure, and intensity offer a taxonomy of U.S. trade grievances that remain largely unresolved. By analysing its content through a language model lens, we can identify the likely members of the Dirty 15, the sectors that will bear the brunt of retaliatory tariffs, and the perspective that frames these moves. No trading partner of the United States can credibly claim they were not warned.

Fernando Martin is Associate Director of the Global Trade Alert and leads the analytics team.