Building Geopolitical Muscle: How Companies Turn Insights into Strategic Advantage

World Economic Forum White Paper January 2026

World Economic Forum White Paper January 2026

Disclaimer

This document is published by the World Economic Forum as a contribution to a project, insight area or interaction. The findings, interpretations and conclusions expressed herein are a result of a collaborative process facilitated and endorsed by the World Economic Forum but whose results do not necessarily represent the views of the World Economic Forum, nor the entirety of its Members, Partners or other stakeholders.

© 2026 World Economic Forum. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, or by any information storage and retrieval system.

Forecasting geopolitical developments has always been difficult, and managing their consequences is now a strategic necessity. Over the past few years, companies have faced profound disruption from trade reconfiguration, economic fragmentation, policy volatility and the weaponization of technology and supply chains. What once seemed exceptional has become a defining feature of global business.

This white paper, Building Geopolitical Muscle: How Companies Turn Insights into Strategic Advantage, is the third edition in a series developed by the World Economic Forum in collaboration with IMD Business School and Boston Consulting Group. The first paper explored how firms understood geopolitics and examined the costs of deglobalization; the second explored how firms strengthened their geopolitical radar. Here the focus is on execution, examining how leading companies are institutionalizing geopolitics within their organizations and building the capability to sense, plan and act amid uncertainty.

Drawing on more than 55 executive interviews across industries and geographies, the paper offers a practical guide for leaders seeking to translate awareness into action. It is intended for geopolitical officers and executives with a geopolitical role, as well as for board members and senior business leaders reflecting on their own organization and strategies. The paper also brings interesting perspectives for government officials and policy-makers who want to understand how the private sector is adapting to this new era of persistent geopolitical disruption.

David Bach, President and Nestlé Professor of Strategy and Political Economy, IMD Business School

Maroun Kairouz, Managing Director, World Economic Forum

Aparna Bharadwaj, Global Leader, BCG Global Advantage Practice; Managing Director and Senior Partner, Boston Consulting Group

Building the capabilities to detect, assess and translate geopolitical signals into decision-making is no longer optional for global companies.

With rising uncertainty, growing trade tensions and weakening international economic institutions, more executives now acknowledge the need for stronger capabilities to sense, interpret and respond systematically to geopolitical dynamics. Geopolitics has climbed up the corporate agenda, and for good reason. It is an area reshaping markets and supply chains worldwide, revising the landscape of risk and opportunity, and it is structurally persistent, sustained by enduring economic, technological and political rivalries.

This research, based on more than 55 interviews with senior executives across sectors and geographies, reveals three key takeaways:

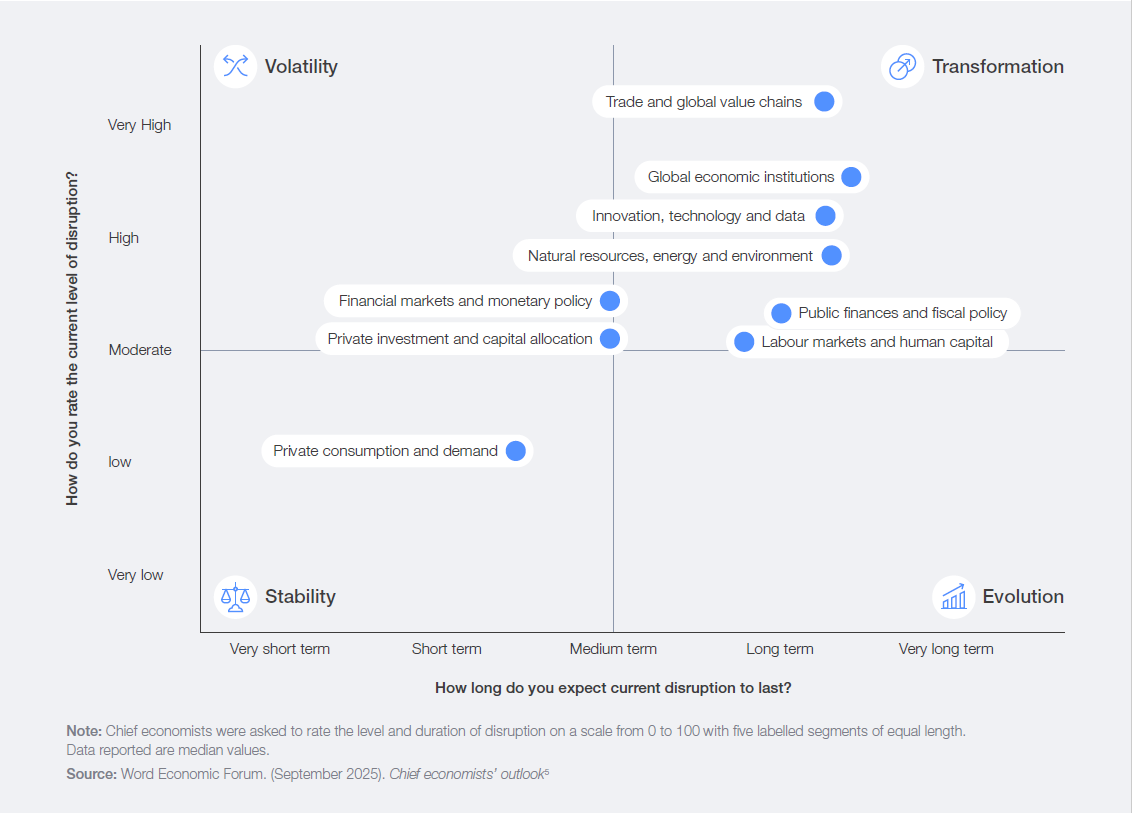

This paper offers a pragmatic toolkit for executives seeking to build or strengthen their geopolitical muscle through five practical building blocks:

Interviews with senior executives from more than 55 global businesses inform a pragmatic toolbox to build geopolitical capabilities.

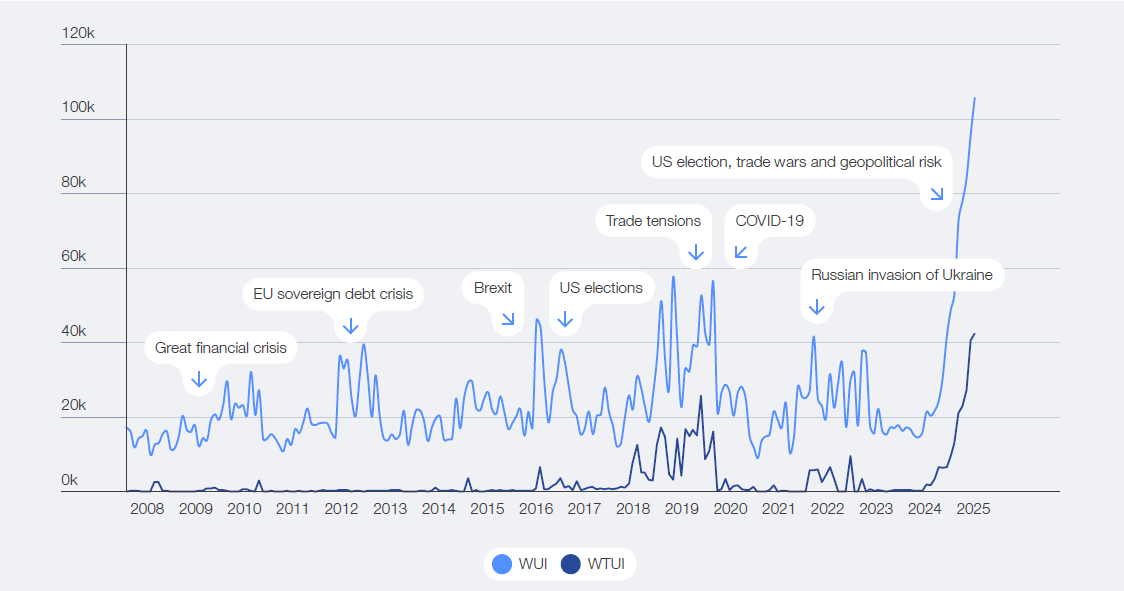

FIGURE 1: IMF Global World Uncertainty Index (WUI) and World Trade Uncertainty Index (WTUI) (January 2008–August 2025)

Note: WUI is computed by counting the % of the word “uncertain” (or its variant) in the Economist Intelligence Unit country reports. The WUI is then rescaled by multiplying by 1,000,000. A higher number means higher uncertainty and vice versa.

Source: Ahir, H., Bloom, N., & Furceri, D. (2022, February), The World Uncertainty Index, National Bureau of Economic Research[1]

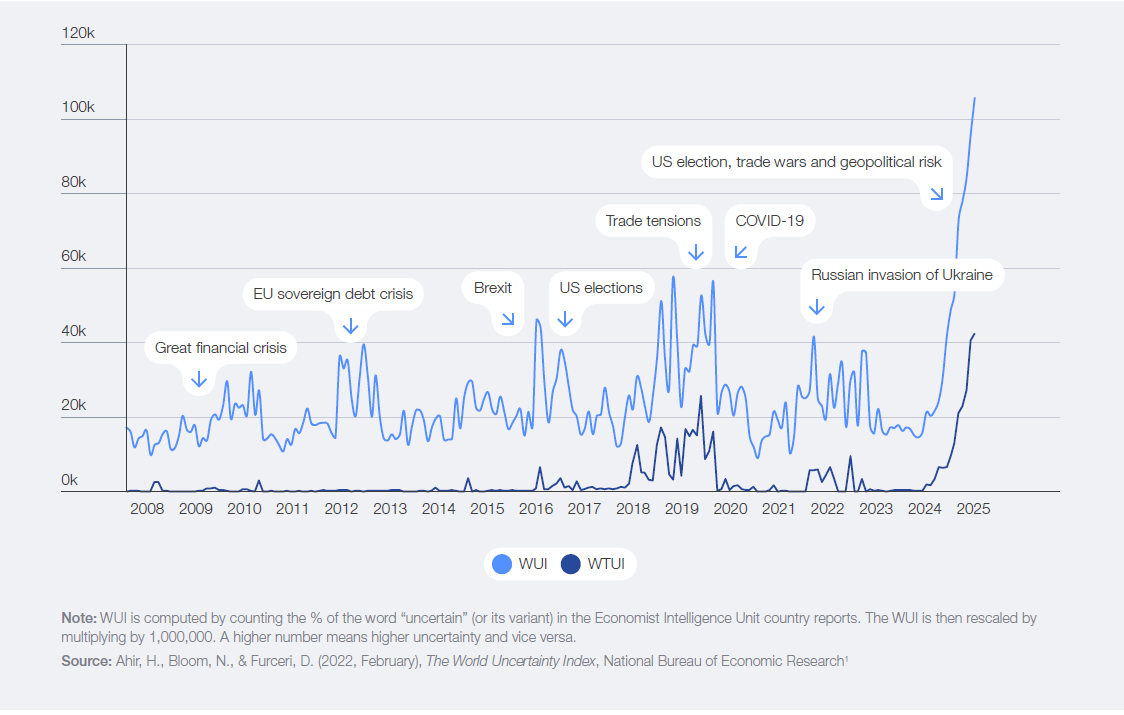

In 2025, global uncertainty reached a 20-year peak (Figure 1), more than four times higher than during the global financial crisis and around 50% above COVID-19 levels. This uncertainty is deeply felt in the business community. In April 2025, 82% of chief economists surveyed by the World Economic Forum characterized current levels of uncertainty as "very high", and 45% expected this uncertainty to remain unchanged or increase in the year ahead.[2] In August 2025, they were asked to assess the scale and duration of disruption from multiple sources (Figure 2). Two stood out as undergoing the most profound and structural transformation: trade and global value chains; and international economic institutions.[3]

Throughout this paper, geopolitics (or geoeconomics, as some executives prefer) is defined as "An act, event, driver or trend that has cross-border and security dimensions likely to impact materially commercial performance."[4] Such acts are typically undertaken by governments, but, as the attacks on shipping in the Red Sea have shown, non-state actors can take geopolitical actions as well.

Geopolitics is both pervasive and persistent. It is globally relevant because the direct or indirect effects of major geopolitical developments are now felt across all regions. The top factors cited by companies interviewed for this study were: US policy volatility and tariffs; the Russia–Ukraine war; US–China rivalry; and European competitiveness. As one executive remarked, "Being global used to be an advantage, now it's becoming a risk." It is likely to remain persistent because the fiscal pressures created by high and growing fiscal deficits in major economies, notably the US, will make tariff revenues politically difficult to unwind.

Meanwhile, competition for technological and economic primacy will sustain elevated levels of rivalry for the foreseeable future, particularly between the US and China and amplified by advances in artificial intelligence (AI).

These forces have pushed geopolitics firmly into the corporate boardroom. Yet this heightened attention does not always translate into strategic advantage. From board directors to C-suite leaders, country managers and operational teams, everyone has a view on geopolitics, often shaped by the latest headlines. While such widespread awareness can sharpen sensitivity to external shocks, it rarely translates into coordinated action.

Only a limited number of firms have moved beyond this stage and built comprehensive geopolitical capabilities. These companies treat geopolitics not as an episodic distraction or risk to manage but as a core and systematic input to decision-making, including on investment, sourcing and sales. Developing this capability takes time, refinement and tangible commitment from the top. Like physical muscle, geopolitical muscle strengthens through consistent use: repeated cycles of assessment, decision and execution.

FIGURE 2 Disruptions in the global economy

Note: Chief economists were asked to rate the level and duration of disruption on a scale from 0 to 100 with five labelled segments of equal length.

Data reported are median values.

Source: Word Economic Forum. (September 2025). Chief economists’ outlook[5]

The purpose of this white paper is to identify the different choices companies are making to develop their geopolitical muscle (i.e. the organizational capabilities that turn awareness into action) and to provide practical guidelines for executives seeking to build or strengthen these capabilities in their own firms. This builds directly on the previous paper, From Blind Spots to Insights: Enhancing Geopolitical Radar to Guide Global Business,[6] which examined how firms detect and assess geopolitical factors.

The evidential basis for this paper comes from 56 interviews with senior executives across multiple industries and geographies. All are drawn from firms with significant international commercial exposure. Interviews were conducted off the record to encourage candour. However, some participants agreed to share their experience publicly, and their cases are profiled in dedicated illustrations throughout the paper.

This white paper is structured in three main sections:

By structuring the paper in this way, the aim is to provide both a snapshot of current corporate practices and a framework for future capability-building.

BOX 1 How the interviews were conducted

Competitive advantage in today’s fractured world depends on rapidly and systematically transforming geopolitical awareness into strategy, investment and operations guidance.

Geopolitical factors now create risks and business opportunities that are too significant to ignore. An automotive company disclosed that tariffs would cut around $4 billion in its bottom line, despite plans to mitigate around 35% of impact. An energy company reported that a major renewable project close to completion was halted in one of its main markets, forcing executives to choose between litigation and diplomacy. They chose the latter, eventually securing authorization to restart.

Strong geopolitical radar and sonar[7] are essential to detect signals, interpret the geopolitical landscape and anticipate the financial consequences. Yet the interviews revealed that only a small minority of firms attempt to quantify their exposure. Most rely on qualitative narratives and scenarios, heat maps or descriptive reports. Quantification is not an end in itself, but it matters. For geopolitics to influence decisions, it must be expressed in business terms to enable executives to compare and prioritize options and the trade-offs between geopolitical exposure and other strategic considerations.

Real value lies not just in spotting signals but in translating them into decisions and doing so quickly and systematically. For the automotive company, this meant reclassifying trade flows, employing specific trade conventions and redesigning parts of the supply chain. For the energy company, it required government engagement and diplomatic outreach at multiple levels to unblock approvals.

Companies that build the capability to translate geopolitical signals into concrete business actions are far better equipped to make strategic decisions based on analysis rather than chance. In a few firms, this capability develops organically, but more often it requires deliberate and sustained investment.

For most organizations, the first response has been to treat geopolitics as a risk-management problem. As one senior executive from a global investor reflected, “Our legacy approach was reactive, built to defend, not to anticipate.” Yet, geopolitical risk management is the first step towards organizational maturity, providing a foundation for more structured resilience.

Effective risk management forces leadership to turn broad uncertainty into achievable mitigation measures: diversifying suppliers, adjusting production footprints and identifying partners or markets that require contingency planning. As one insurance executive explained, “Resilience costs money; you need to arbitrate the trade-off between profit and resilience.” In capital-intensive industries, this trade-off is particularly acute. An industrial company described its challenge succinctly when discussing its manufacturing footprint in geopolitically exposed regions: “Exit too early and we lose; exit too late and we lose.” Managing that balance between cost effectiveness and strategic flexibility has become a defining test of effective geopolitical risk management for global firms.

Yet geopolitics is not only a source of risk, it also creates opportunities for companies able to navigate it effectively. This is more challenging in industries that have made the most of global scale and have limited scope to localize their operations. However, some geopolitical shocks enable firms to differentiate and capture advantage. For example, EU sanctions imposed on Belarussian potash in 2021 and tariffs announced in 2025 on Belarussian and Russian fertilizers disrupted supply chains but also opened new market opportunities and competitive dynamics for both European and non-European producers.

These opportunities emerge in different ways, through reputation, strategic moves, policy engagement and influence or commercial positioning, depending on geopolitical disruptions and sectors. using geopolitical insights to calibrate their commercial pitch and secure part of a split order contract. The first advantage is reputation: in complex markets, operational continuity builds trust. A logistics leader summed it up: “Clients trust us because we’ve proved we can operate even in hostile environments.” The second is strategic: when competitors retreat under regulatory pressure, those who stay or return early capture market share. A third lies in policy engagement. Firms that engage constructively with governments and multilateral institutions can contribute to informing regulation. A critical infrastructure company, for instance, maintains regular dialogues with more than 10 governments on infrastructure resilience and regulation. Targeted geopolitical understanding can also support business growth. One company interviewed demonstrated this during a recent tendering process in a South-East Asian country, using geopolitical insights to calibrate their commercial pitch and secure part of a split order contract.

Mature firms, those further along in developing geopolitical capabilities, ask different questions. Organizations with ad hoc and sporadic capabilities ask “What is happening?” or “Who should respond?” losing valuable time. Those that are more advanced, with more systematic and institutionalized muscle, ask “How should we respond?” and “When is the right moment to act?” The shift is subtle but decisive: it turns geopolitics from a sporadic shock to a managed variable of corporate strategy.

"Geopolitics is not always a risk; it can also enhance reputation, open strategic opportunities, deepen policy engagement and support commercial positioning."

Defining what geopolitical muscle means in practice awareness directly to business decision-making. The essential feature is not hierarchy but integration: In most companies, geopolitics has long been the domain of the CEO or the board, addressed episodically when crises arise or when state relations directly affect operations. That model is no longer sustainable. The frequency and simultaneity of shocks now demand institutionalized capacity, not infrequent attention by individuals. Geopolitical muscle represents this institutionalization: the ability to sense, reoptimize and act at scale systematically. It is the difference between knowing that a new export ban is coming and having a ready playbook to adjust procurement, engage regulators and brief customers.

A few firms have already moved in this direction. A global investment firm headquartered in Asia has developed a globally distributed geopolitical team with hubs in Washington, Brussels and Beijing, embedded directly in investment committees. An industrial goods company created a geopolitics and international relations unit within its government affairs function, with strong ties to the board of directors, enterprise risk management (ERM) and business lines.

Yet fewer than 20% of the companies interviewed have an explicit geopolitics or international relations unit. Most integrate this capability within existing structures. Having a geopolitically explicit function can help clarify and locate ownership, but it is not sufficient on its own to secure a competitive advantage.

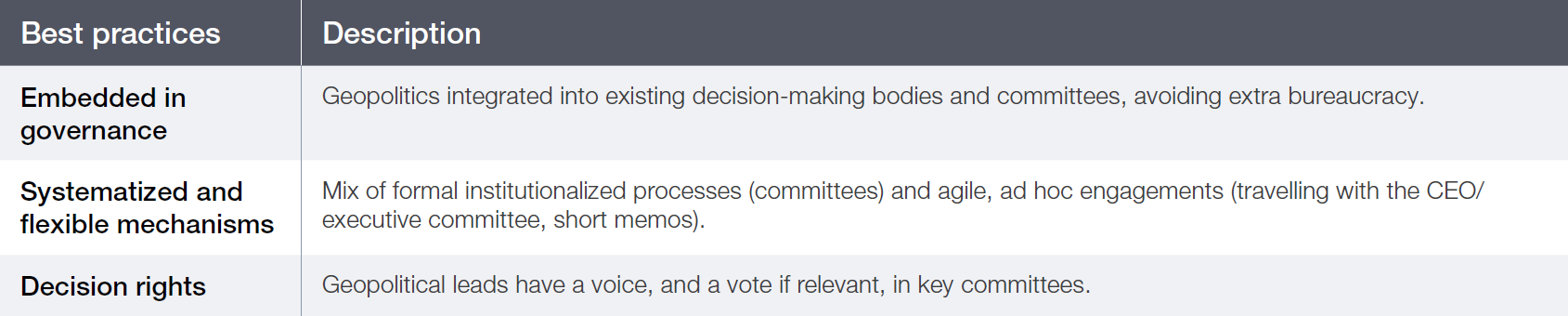

Despite differences in structure, the best performers awareness directly to business decision-making. The essential feature is not hierarchy but integration:

The research for this paper highlights five essential building blocks (Figure 3) that together define what it means to build geopolitical muscle:

FIGURE 3 Five building blocks behind geopolitical muscle

There is no single blueprint for success when building geopolitical muscle. Different companies face different exposures, opportunities and constraints. Muscle-building tends to be shaped by factors such as company size, global footprint, ability to localize, home-country context, sector, capital structure, organizational blueprint and the available talent pool. Each can succeed when coherence exists between ambition and design.

Effectively embedding geopolitics into decision-making requires a pragmatic, end-to-end approach. This section outlines five building blocks and practical options to getting started.

At EDF, geopolitics is approached not just as a risk but as a lever for strategic positioning. The International and Government Affairs function, led by a former diplomat, is designed to be proactive: supporting business units in their bidding processes and business-to-government (B2G) interactions, while also engaging closely with French and EU institutions to shape a conducive regulatory environment.

Operating as a lean, network-based model, the leader is a trusted adviser to the CEO, spending most of his time on geopolitics and EU affairs. Acting as an orchestrator, he is supported by one deputy and a broader network of correspondents (i.e. 5–10 full-time-equivalent employees) across regions and business units. For complex and highly sensitive issues (e.g. Brexit), EDF can activate ad hoc task forces with more regular and cadenced cross-functional coordination.

Beyond scenario planning, the emphasis is on active, conversational engagement, not long memos. Communication is direct and agile: brief updates, touchpoints and regular participation in key decision-making forums.

This proved critical during recent mergers and acquisitions (M&A) operations. The team was involved from the outset, enabling EDF to navigate the political complexities, align with state actors and secure the deals after months of negotiations.

Source: Interviews, company analysis

Siemens established its dedicated geopolitics function back in 2020 – during the COVID-19 pandemic and after years of navigating geopolitical shifts related to Russia and rising US–China strategic competition – with the goal of anticipating and navigating geopolitical risks and opportunities, while connecting the dots globally. The role intertwines geopolitical advisory, external advocacy, cooperation and business development and operational excellence.

The geopolitical function is led by the Global Head of Geopolitics and International Relations at Siemens. A multidisciplinary team – based in Brussels, Berlin and Munich – is part of a broader Government Affairs (GA) team in HQ coordinating a global network of counterparts based in local Siemens companies. Initially structured by geographic expertise, the team has been specializing in global themes such as geopolitics, geoeconomics, global trade, investment, technology and conflicts, among other topics.

At Siemens, geopolitical advisory blends a key balance between internal advisory and external engagement. The geopolitics team actively engages with policy-makers in countries globally, international organizations and fora (e.g. the World Economic Forum, OECD, UN, WTO, B20), academic networks, global business associations, think tanks and consultancies.

To process this flow of information, Siemens has built a suite of in-house tools that help the team filter noise and prioritize emerging risks and opportunities. Ranging from implemented foresighting models, trends and scenarios and in-depth country assessments, to new tools under development, such as an AI-powered geopolitical radar and other applications, Siemens is strengthening its capabilities using structured databases, application programming interface (API) and expert knowledge.

The team created a combination of proprietary methodologies such as the “Geopolitical Trends and Scenarios Report”, “GA Intelligence Tool” and “Value at Stake” to foresight, quantify and prioritize the potential financial impact of geopolitical developments across dimensions such as market access, top-line revenue, bottom-line impact, technology exposure or a country’s attractiveness.

Geopolitical insights are embedded directly in ERM, annual strategy planning and quarterly investors’ calls. Scenario planning is now regularly presented at board level and to task forces. In addition, board members receive tailored geopolitical briefings relevant to their portfolios, spanning topics from AI to the geopolitics of sustainability. The team maintains regular direct contact with the CEO’s office and business leaders through direct briefings and tailored presentations to executive teams.

“Internal demand is consistently growing: today, we get requests from the board level to businesses’ product line,” says the Global Head of Geopolitics and International Relations.

Source: Interviews, company analysis

"Our chairman told the board, ‘We need more international expertise.’ That led to re-establishing our international relations function with a mandate that spans both long-term strategic foresight and short-term tactical operational guidance.

Head of International Relations at an energy company"

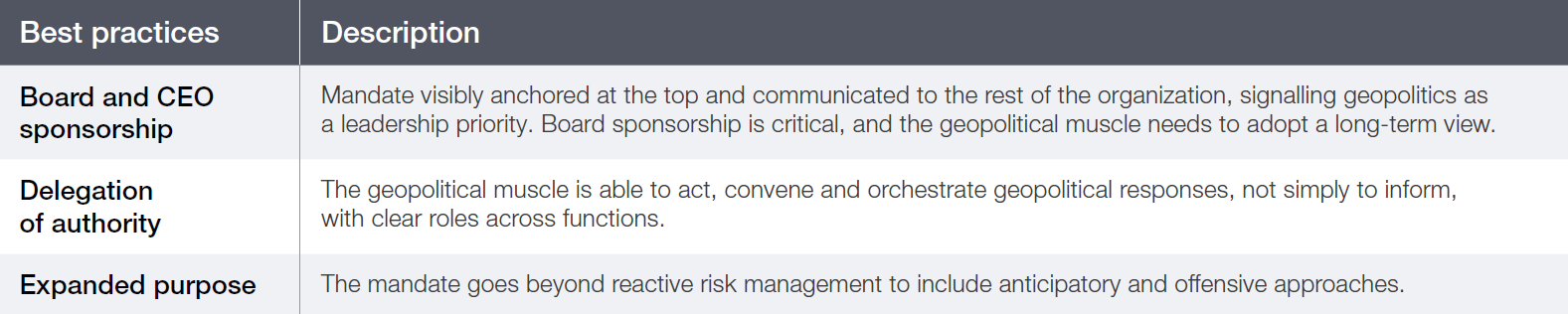

Many board members, CEOs and other executives now recognize the need for empowered geopolitical muscle: a dedicated capability with delegated authority to anticipate and orchestrate the company’s response to global developments. Companies with long-standing exposure to geopolitics (such as in energy or commodities) tended to evolve such functions earlier. For others, two inflection points accelerated this realization: the COVID-19 pandemic in 2020 and Russia’s full-scale invasion of Ukraine in 2022. These crises revealed that ad hoc coordination or personal networks could not substitute for institutional readiness.

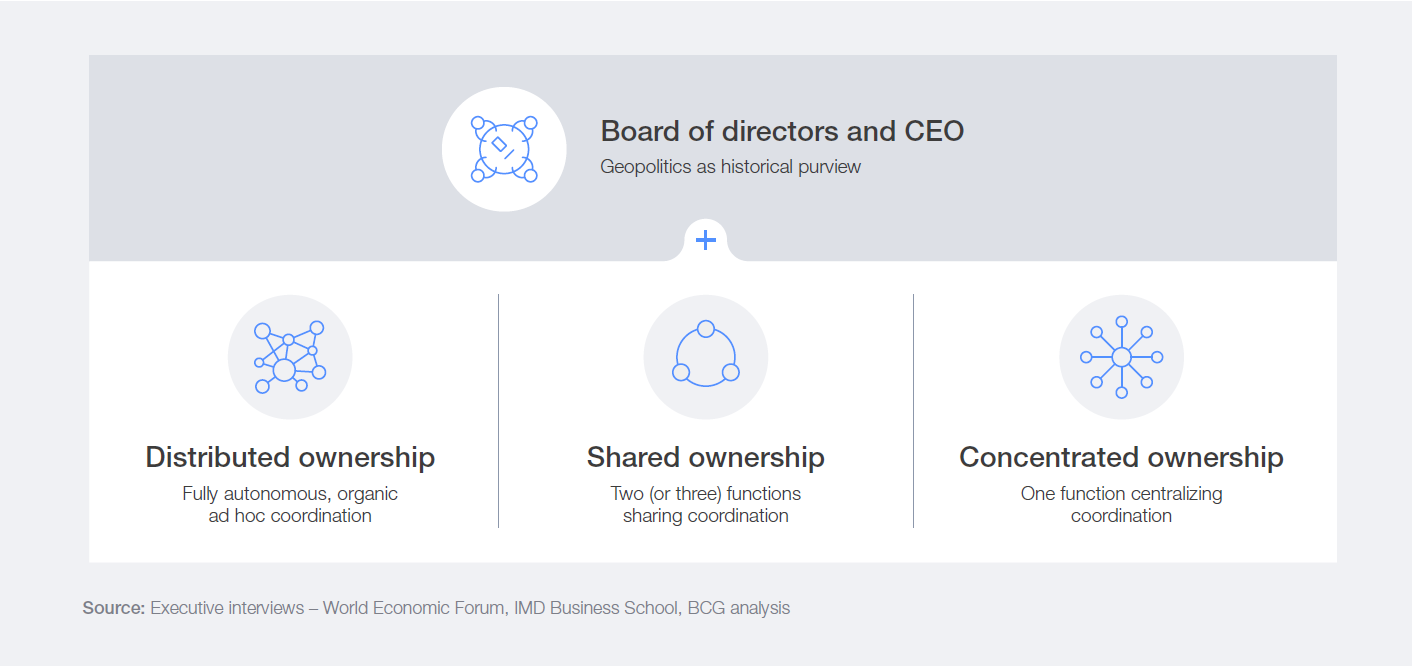

FIGURE 4 Ownership of geopolitical muscle

The geopolitical muscle acts as orchestrator, not final decision-maker. How this authority is delegated differs by company design and maturity (see Figure 3):

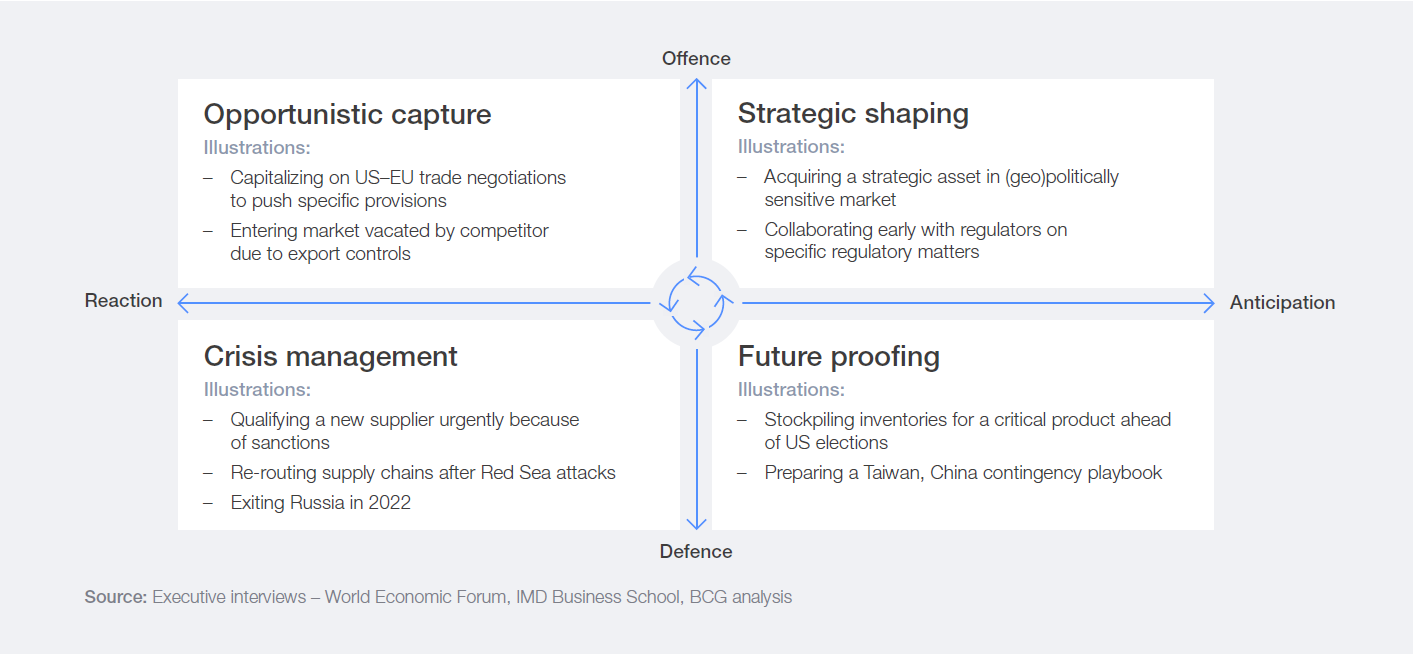

Across firms, mandates tend to span two axes: defence (risk) vs. offence (opportunity) and reaction vs. anticipation, producing four distinct objectives. Many companies interviewed described an evolution in their priorities as they strengthened their capabilities from reactive crisis management towards focusing more time and

FIGURE 5 Different objectives guiding geopolitical muscle mandate

Allianz accelerated the structuring of its geopolitical capabilities back in 2019. What began as a largely regulatory affairs function under the group CFO evolved rapidly into a broader Regulatory and Political Affairs (RPA) function. By 2022, it was elevated to report directly to the group CEO.

Led by a long-time Allianz executive, the core RPA department at HQ level is supported by a regulatory and political affairs core group spanning key regions and business lines, which defines the global RPA strategy, methodologies and priorities (15-plus stakeholders) and exchanges regularly on current issues. Its mandate: help Allianz both navigate and shape the firm’s regulatory and political environment. The team reports into core decision-making bodies across finance, risk, strategy and operations. As the Head of Group Regulatory and Political Affairs puts it, “We moved from hosting three or four of our own steering committees per year to having a seat in the forums where decisions are made.”

Geopolitical monitoring is anchored in a structured, data- driven approach and performed from different perspectives. The firm’s Political Stability Grid tracks political risk across 25-plus key markets. It integrates internal exposure data with external inputs and evaluates developments over multiple time horizons. Findings are delivered at least twice a year, or more frequently as needed, with optional deep dives for business units. In addition, a geopolitical risk update, delivered at least three times a year, offers deep dives into the four to five of the most significant geopolitical risks. The product portfolio is complemented by previews ahead of critical elections. A one-year scenario planning process ahead of the 2024 US election exemplifies its impact. Working across different functions, including economic research and risk management, the team ensured that strategic responses were aligned, proactive and board-ready.

Source: Interviews, company analysis

LATC has felt the impact of growing geopolitical uncertainty, notably in its retail branch. The company initially found itself in firefighting mode, but quickly activated and strengthened its geopolitical capabilities to coordinate a response. This was reflected in an organizational shift to embed geopolitics more directly into the strategic core. A chief trade officer role was added to the responsibilities of the chief strategy officer, reporting directly to the CEO and sitting on the executive committee. This team, comprising seven professionals, also includes a dedicated Geopolitics and Market Intelligence unit.

This pivot has allowed LATC to shift from a reactive posture to a more proactive stance, developing its own “house view” on geopolitical developments and using it to shape conversations with regulators, trade bodies and multinational partners.

Source: Interviews, company analysis

“ You can talk endlessly about what is happening, but the real question is the ‘so what’. Geopolitics matters when you bring it back to the business: how we navigate it, what it means and what we do next.

Head of Global Affairs at a chemical company "

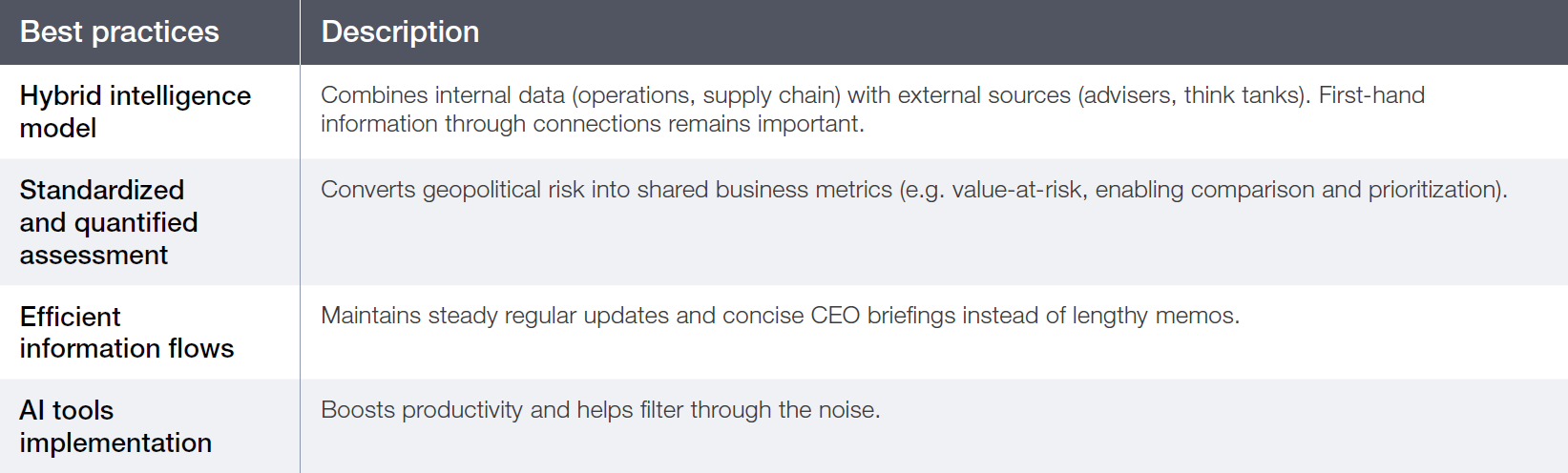

The first line of information comes from local offices and management teams. They are closest to clients, regulators and local news sources, uniquely positioned to highlight weak signals, regulatory developments or political shifts that might later scale into major disruptions. A competitive advantage arises from the combination of:

To sustain this connection, some companies organize field visits or site rotations for central teams, ensuring proximity to local contexts and perspectives. Others conduct quarterly or semi- annual risk scans to structure information flows between the periphery and headquarters.

Developing local leaders’ geopolitical awareness is also critical. One interviewee recalled a country manager declining to meet the local finance minister, asking, “Why would that be relevant for us?” – a reminder that (geo)political sensibility must become part of leadership skill sets at every level.

Beyond “farming” internal data, leading firms actively “hunt” for external insights across three broad categories:

Collecting intelligence is only the first step. Turning it into strategic insight requires structured assessment. Companies interviewed typically operate along three levels of maturity:

Despite the widespread availability of information, data and commentary, the use of Al for geopolitical sensing remains limited. Most companies still rely on manual curation or consultant summaries to filter noise. A few, however, are experimenting with Al pilots to automate signal processing. One company reported training a large language model (LLM) on its proprietary methodology to collect, synthesize and generate board-ready materials. As Al tools mature, they may increasingly support early-warning systems, scenario generation and rapid briefing production.

Rio Tinto's early attempt to provide geopolitical expertise via generalist political advisers lacked impact with business units. "We had good conversations," recalls the Head of Group Government Relations and Civil Society, "but it was not always in a language that the business could act on."

The company has since shifted to a more distributed, business-integrated model anchored in operational exposure. Geopolitical response is owned by Government Relations and Civil Society, orchestrating cross-functional task forces. Each group - typically around 10 people spanning legal, risk, procurement, commercial and regional teams - is tailored to a specific issue, such as tariffs or US-China tensions, and meets on a regular cadence. A dedicated project management office (PMO) ensures action tracking and delivery.

Rio Tinto uses niche external experts (sanctions lawyers, trade negotiators, regional security analysts) tailored to the issue. "We moved away from generalists, we now go niche, and it is successful." Risk is quantified in business terms (volumes, cost, margin impact) and aggregated by central teams. "The business absolutely quantifies the risk, and we aggregate that view for the board."

The model proved its value in 2025, when US tariffs were introduced. With scenario planning in place, a task force mobilized immediately to take action, adjusting supply chains, engaging regulators and safeguarding customer relationships. "We didn't panic; we zoomed in on which businesses were affected and proceeded to manage the risks."

Source: Interviews, company analysis

"You really need someone who is either a dedicated geopolitical person or who wears the geopolitical hat and has a senior adviser on their team who's a full-time geopolitical expert. They should be accountable to a permanent member of the management team or very close to the CEO, with a direct line to decision-makers.

Head of Geopolitical Advisory at a global investment bank"

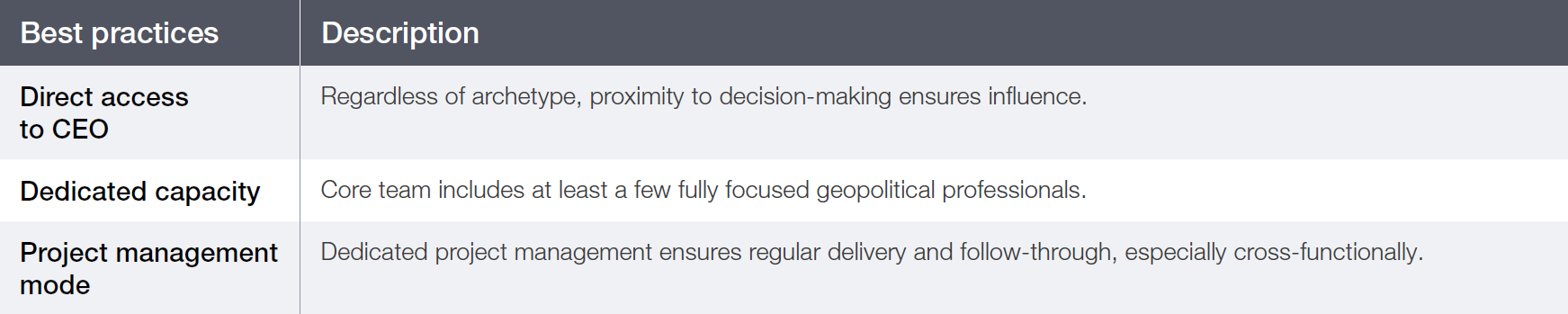

When designing the operating model, one of the first questions companies face is where the function should sit. However, its influence depends less on formal location than on how effectively it coordinates across functions and connects with decision- makers. In practice, more than half of the companies interviewed house their geopolitical capability within government or corporate affairs. Fewer than 20% have established a dedicated geopolitics or international relations function reporting directly to the CEO. Regardless of configuration, one success factor remains constant: proximity to the CEO. Direct access to leadership ensures relevance, speed and authority in moments of disruption.

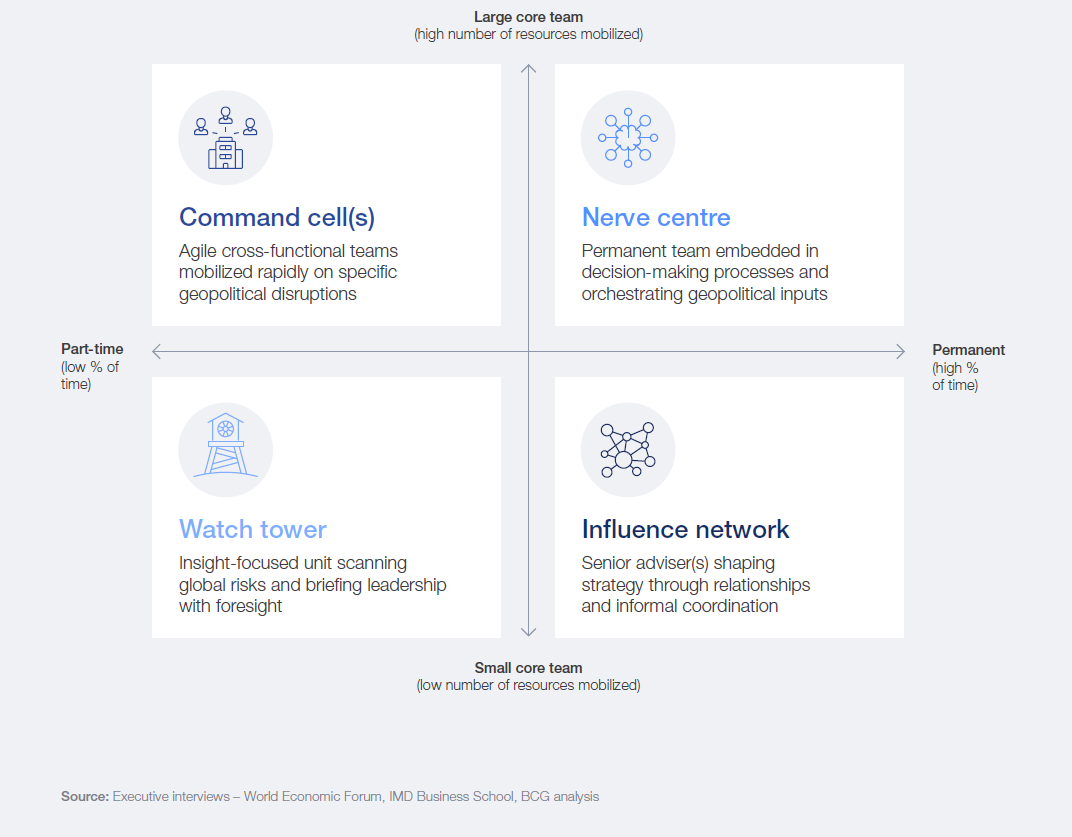

Beyond the "host function", there are four main operating model archetypes to design the geopolitical muscle.

FIGURE 6 Positioning operating model archetypes by resource intensiveness

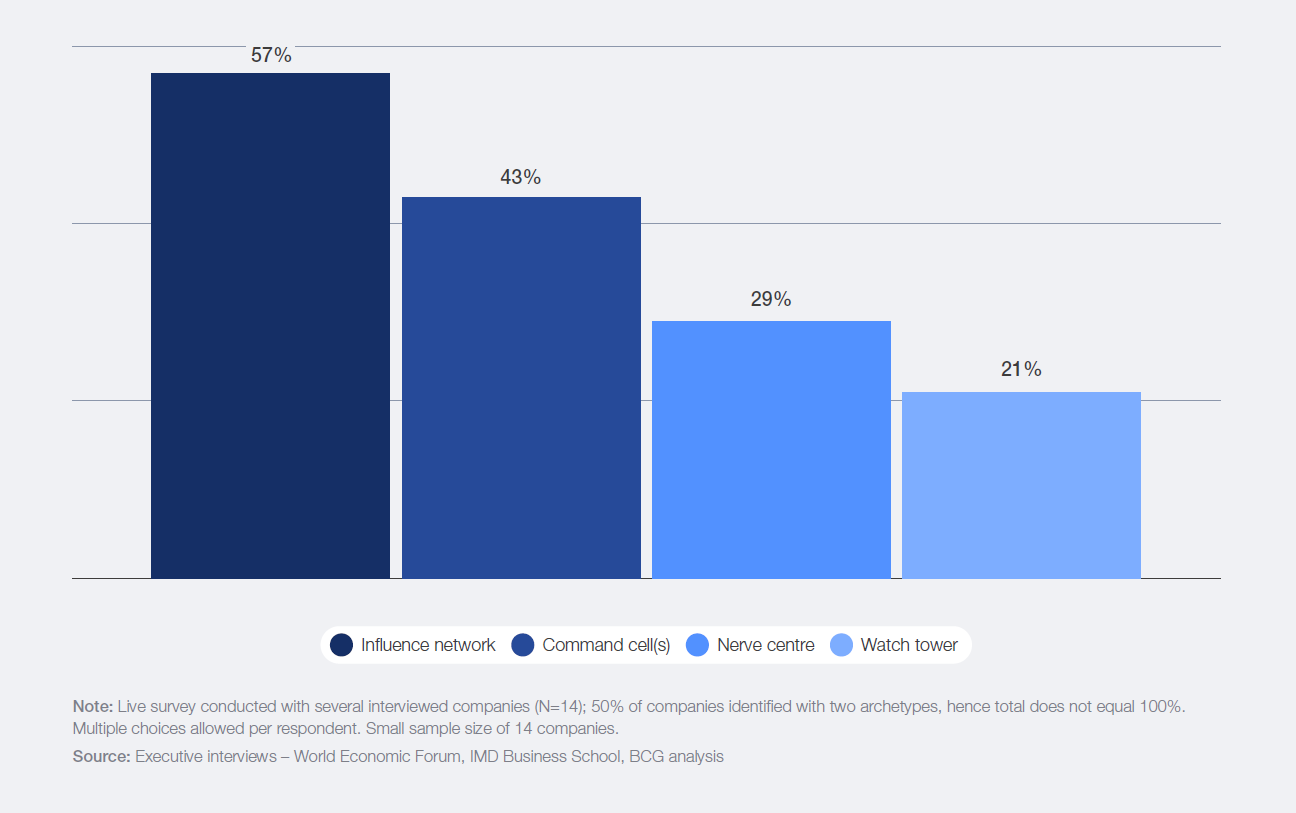

The archetypes are not rigid categories; many firms blend features of two models or evolve over time as priorities change. Some 50% of companies surveyed self-identified with two archetypes, their operating model varying depending on the issue at stake.

FIGURE 7 Distribution of archetypes across surveyed firms based on self-identification

At Teva Pharmaceutical, geopolitical disruptions – from the threat of tariffs to most favoured nation (MFN) pricing rules and regional instability – have become recurring features. These dynamics are already shaping how the company evaluates pricing strategy, market presence, cost structures, capital allocation and even its innovation pipeline. "We are much more detailed because of the potential consequences," notes the US Executive Vice-President Commercial.

Responsibility for geopolitical processing sits within Global Government Affairs. The core team is embedded in a broader network of 30–50 professionals across finance, legal, operations and regional teams. In April 2025, Teva Pharmaceutical created a Tariff and Policy Command Centre. Structured as a war room, convening every week, it brings together leaders from multiple functions and has a direct line to the CEO and CFO. As the US CFO puts it, "This isn't just tariffs, it's now about policy, intellectual property, MFN and long-term structural change."

When tariff risks emerged in 2025, the company identified a critical oncology drug manufactured in India as vulnerable. The command centre moved quickly, building up inventories in the US ahead of potential duties. The decision ensured supply continuity for cancer patients in the region

Source: Interviews, company analysis

"We already have the right skills in the company: strategy, marketing, policy advocacy, deal-making, risk management. The real challenge is connecting them to see the full picture.

Head of Strategy at a mining company"

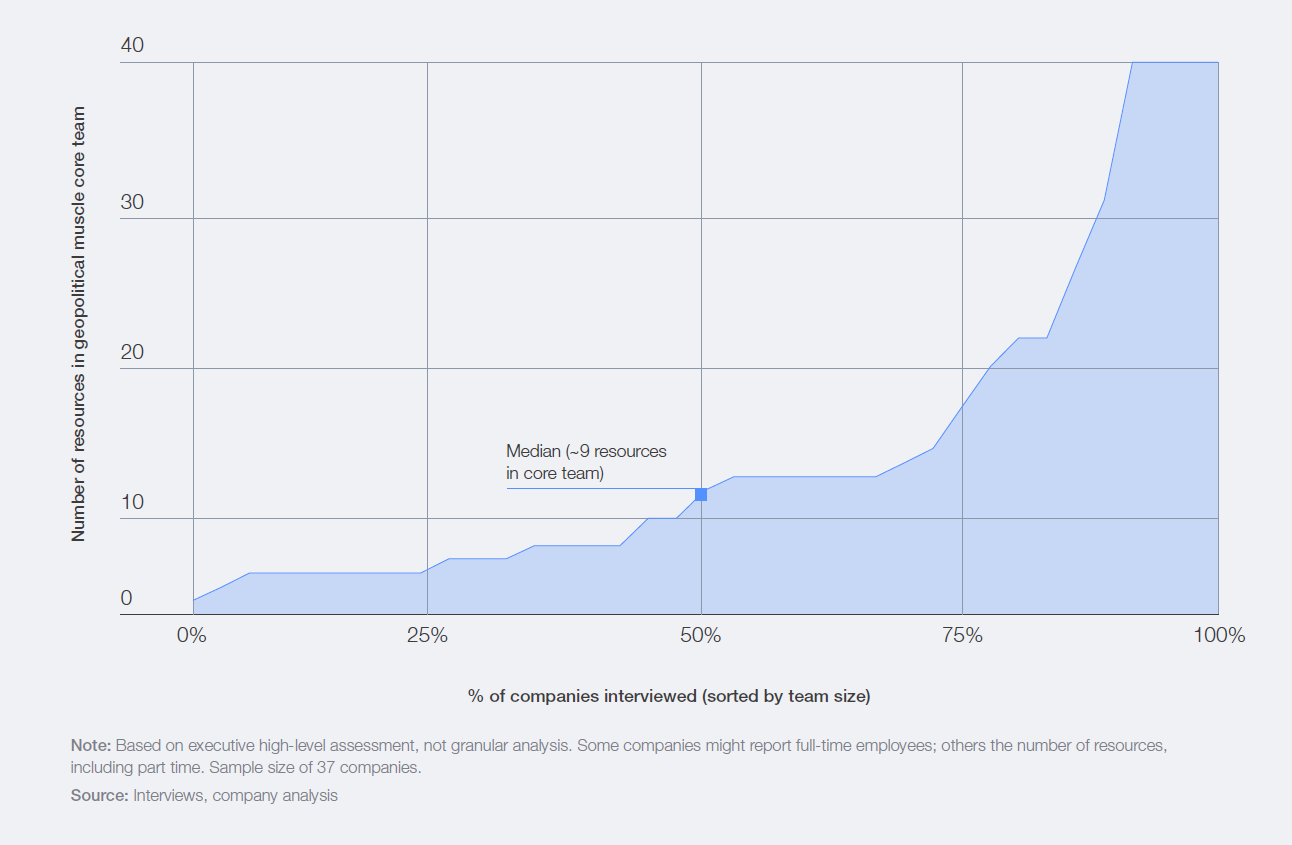

Assembling the right talent is a critical step in building geopolitical muscle. Experience, credibility and analytical capability determine whether teams can bridge geopolitics and business.

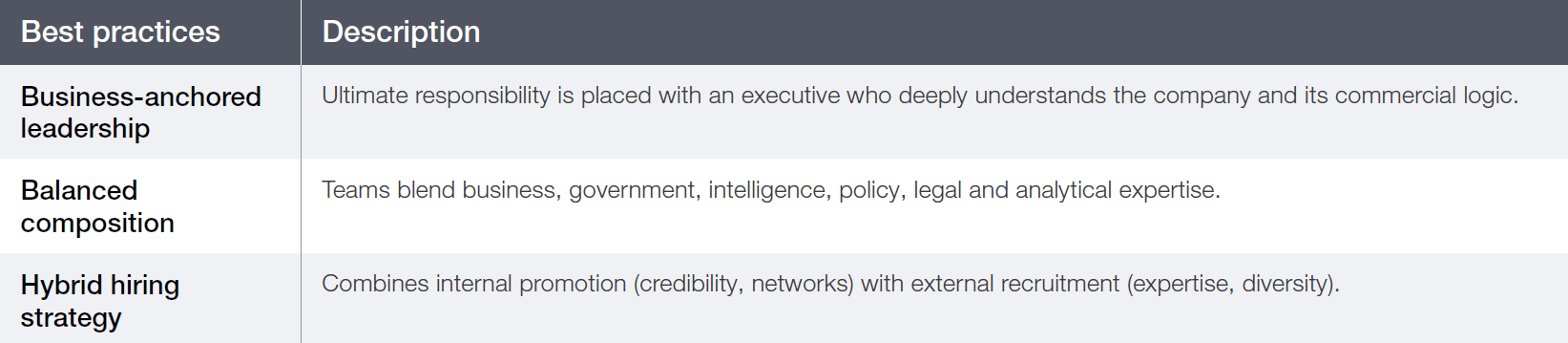

When building geopolitical muscle, companies must decide first who will lead the function:

Across interviews, executives emphasized that the ultimate responsibility for leading a geopolitical team is best placed in an executive with long-standing experience of the company or business. Such leaders understand how the company competes, how decisions are made and where trade-offs truly lie. They can translate geopolitical analysis into commercial implications and ensure that recommendations resonate with both the board and the front line.

Beyond the leadership of the geopolitical muscle, there is value in diverse backgrounds within the core team and a broad network of other contributors. The hosting function, however, often inadvertently induces a recruitment bias – for example, diplomatic background in government affairs, consultants in corporate strategy).

The most effective teams know how to combine distinct perspectives. Common professional backgrounds include government and diplomacy, security and intelligence, legal and regulatory affairs, corporate strategy and long-standing industry experts who understand the company's commercial realities.

Seniority balance is also important. Senior staff bring credibility, networks and the ability to engage peers across the executive committee and external policy-makers, while more junior team members contribute analytical and project management competences.

"Ultimate responsibility for leading a geopolitical team is best placed in an executive with long-standing experience of the company or business."

FIGURE 8 Distribution and spread of core geopolitical muscle team size

As Airbus strengthens its geopolitical function, the goal is to formalize and systematize assessment and embed it into commercial and other decision-making processes. The mandate is twofold: translate external events into business impact and build a cross-functional community of practice. "It's a different vocabulary: ministers, heads of state do not speak the same language as procurement teams," says the Head of International Business Growth.

Initially, Airbus considered high-profile external candidates (former ambassadors or generals) who would bring credibility and reputation. Yet that posed integration and alignment challenges. The company ultimately opted for an internal hire, someone with deep Airbus knowledge and a strong external network, able to activate the ecosystem quickly. Interest was high, with strong engagement across functions.

Source: Interviews, company analysis

"You can do a risk exercise: a dashboard of risks, a long list, a heat map, updated quarterly, re-underwritten annually, etc. That has some value in terms of situational awareness. But the real need is the ability to quickly integrate geopolitical insights into strategic or operational decisions the firm is facing.

Head of Geopolitical Advisory at a global investment bank"

The geopolitical muscle plays a critical role as the bridge between the board and the C-suite on one side, and corporate functions and business units on the other. Its purpose is not only to inform and advise but also to connect, convene and coordinate, ensuring that geopolitical awareness translates into consistent decisions across the organization.

At the top, the geopolitical muscle supports both the board of directors and the executive leadership by providing targeted, timely intelligence.

Beyond advising upwards, the geopolitical muscle contributes across corporate functions, where it can inform, convene and in some cases help arbitrate decisions. Interviews revealed eight decision domains where geopolitical considerations are most frequently integrated.

TABLE 1 Main decision domains to embed geopolitical muscle

Despite this growing scope, the majority of companies interviewed still rely on ad hoc mechanisms to inject geopolitical insight into decisions. While flexibility has advantages, the absence of formal routines can create inconsistency across geographies, business units and time horizons. Without adding bureaucratic layers, systematizing geopolitical input, even through light-touch templates or standing agenda items, can enhance alignment and accountability.

Companies seeking to embed geopolitics into decision-making should start by asking four simple but pragmatic questions:

Philips' geopolitical set-up emerged during COVID-19, when health tech became strategically sensitive. Government Affairs leads cross-functional coordination and reports to the Chief ESG and Legal Officer. The company uses a task-force model to respond to risks like US tariffs: delivering impact assessments, advocacy messaging and board updates. A standing Trade Policy and Geopolitics Committee oversees horizon scanning and risk tracking. The team holds monthly check-ins across procurement, trade compliance, tax, legal, government affairs and integrated supply-chain strategy, and maintains a risk tracker with quantified impact assessments.

Source: Interviews, company analysis

Nissan's geopolitical muscle is focused primarily on risk mitigation and defence. Risk exposure is assessed through a three-tier framework, categorizing risks as below ¥10 billion, below ¥100 billion or above ¥100 billion* in operating profit impact.

Responsibility sits within the Strategy department, with a small central group responsible for ongoing scanning and issue identification. The team operates from a business perspective, while a separate crisis management team, staffed with regional specialists, provides geopolitical expertise for employee safety and continuity planning.

For high-impact issues, Nissan activates cross-functional task forces. For instance, the tariff task force (30–40 members) meets twice a month to identify necessary actions and confirm the progress of actions with regular reporting to the CEO and CFO. Another task force focuses on sourcing and supply-chain vulnerabilities from short-term to long-term items. Inputs from both feed into a corporate risk map, which informs long-term strategic planning.

* ¥10 billion is equivalent to c. $64 million, ¥100 billion to c. $640 million. Source: Interviews, company analysis

Building geopolitical muscle is an ongoing journey: organizations evolve and refine their models as experience and exposure grow.

Beyond developing geopolitical muscle through the five building blocks explored in this paper, executives are invited to consider additional factors. Historical precedent suggests that current geopolitical tensions will persist for an extended period. Companies should prepare for an environment where cross-border commercial ties, technologies and resources become instruments of statecraft, while cyberattacks and other forms of hybrid warfare remain probable scenarios. These factors indicate that companies will require sustained geopolitical capabilities for years to come.

There are several considerations to guide executive leadership in the coming years regardless of geopolitical muscle starting point:

Emphasizing risk avoidance alone might not provide a sufficient foundation for sustained investment in geopolitical capabilities because of two main challenges:

However, when apparent, external validation on effective risk management helps make the business case for properly resourcing a geopolitical function – for instance, financial markets may reward firms that demonstrate superior management of geopolitical risk through lower capital costs. But the case for investment becomes more compelling when geopolitical capabilities identify opportunities for strategic advantage or innovation. Proactive firms can, for example:

Indicators and metrics of value creation are not straightforward to determine and monitor without creating unnecessary layers of reporting, but there is value in factoring in this consideration early in the process of developing geopolitical capabilities.

When developing geopolitical capabilities, firms benefit from structured engagement with privatesector peers from different geographies and sectors, notably those with a long history of dealing with geopolitics or those that have been most impacted in recent years. To prepare for this, companies can:

Corporate geopolitical functions should develop assessments of economic security considerations relevant to their businesses. The Organisation for Economic Co-operation and Development (OECD) defines economic security as “a nation’s ability to protect and sustain its economic stability and growth by strengthening its resilience against external and internal threats”. It includes the ability to “safeguard key economic assets, maintain critical infrastructure and ensure access to essential resources such as energy, food and technology”.[9] G7 governments and the European Commission frequently frame geopolitical matters through an economic security lens.[10] Understanding this perspective facilitates more productive engagement with these governments.

The evolution of corporate geopolitical capabilities since the COVID-19 pandemic presents significant learning opportunities. Both public and private sectors can benefit from this development. In that regard, trusted public–private platforms fulfil an important convening role, enabling experts to share ideas and assessments. Of course, competition law restrictions must be respected in all such engagements.

Vanguard firms have adopted more sophisticated approaches to geopolitical assessment. They increasingly employ whole-of-value-chain perspectives. This analytical focus aligns with broader governmental concerns about the wideranging knock-on effects of geopolitical disruption.

Governments can gain valuable insights from firms with advanced geopolitical capabilities. Privatesector syntheses may reveal new ways in which diverse signals can be integrated into achievable assessments. This represents an area where government and business can exchange and learn from each other’s experiences. Governments might consider combining enhanced integration of insights from their national security apparatus with private-sector analysis. Some classified intelligence may not be appropriate for sharing with the private sector; however, sophisticated private-sector assessment of economic interdependencies and market dynamics offers complementary value.

The resulting insights could better illuminate how geopolitical developments affect societies. In many fraught situations, both government officials and corporate executives have a strong stake in business continuity.

Geopolitics has become an unavoidable dimension of corporate strategy. For many companies, it now conditions investment priorities, access to markets, business continuity and even innovation choices. This new reality requires not just sharper awareness, but stronger muscle.

This white paper shows that while most organizations have made progress in integrating geopolitics into leadership discussions; however, few have the systematic capabilities needed to turn insight into execution. The companies that stand out share a common pattern: clear mandates anchored at the top, robust radar and sonar to detect signals and trends, adaptive operating models, credible leadership and talent, and disciplined integration into decision-making.

As global uncertainty remains elevated and geopolitical rivalry alters the global business landscape, corporate geopolitical muscle will have to adapt. Firms must remain agile to reshape structures and processes as the sources and nature of geopolitical tensions continue to evolve. The task ahead is to move from building capabilities to demonstrating impact: showing how geopolitical readiness enhances resilience, accelerates opportunity capture and strengthens long-term competitiveness.

Thomas Bedouet

Consultant, Boston Consulting Group; Project Fellow, World Economic Forum

Simon J. Evenett

Professor of Geopolitics and Strategy, IMD Business School; Co-Chair, Global Future Council on Trade and Investment

Nikolaus Lang

Global Leader, BCG Henderson Institute; Chair, BCG Center for Geopolitics; Managing Director and Senior Partner, Boston Consulting Group

Cristián Rodríguez Chiffelle

Partner and Director, Trade, Investment and Geopolitics, Boston Consulting Group

Sean Doherty

Head, International Trade and Investment, World Economic Forum

Thomas Gratowski

Insights Director, Center for Geopolitics, Boston Consulting Group

Nivedita Sen

Lead, Trade and Insights, International Trade and Investment, World Economic Forum

Aditi Sara Verghese

Policy Lead, International Trade and Investment, World Economic Forum

Production

Laurence Denmark

Creative Director, Studio Miko

Xander Harper

Creative Director, Studio Miko

Simon Smith

Editor, Astra Content

1. Ahir, H., Bloom, N., & Furceri, D. (2022, February). The World Uncertainty Index. National Bureau of Economic Research. https://www.nber.org/papers/w29763

2. World Economic Forum. (2025, May 28). Chief economists outlook: May 2025. https://reports.weforum.org/docs/WEF_Chief_Economists_Outlook_May_2025.pdf

3. World Economic Forum. (2025, September 23). Chief economists’ outlook: September 2025. https://reports.weforum.org/docs/WEF_Chief_Economists_Outlook_September_2025.pdf

4. World Economic Forum. (2025, January 16). From blind spots to insights: Enhancing geopolitical radar to guide global business. https://reports.weforum.org/docs/WEF_From_Blind_Spots_to_Insights_2025.pdf

5. World Economic Forum. (2025, September 23). Chief economists’ outlook: September 2025. https://reports.weforum.org/docs/WEF_Chief_Economists_Outlook_September_2025.pdf

6. World Economic Forum. (2025, January 16). From blind spots to insights: Enhancing geopolitical radar to guide global business. https://reports.weforum.org/docs/WEF_From_Blind_Spots_to_Insights_2025.pdf

7. Ibid.

8. The White House. Executive order. (2025, May 12). Delivering most-favored-nation prescription drug pricing to American patients. https://www.whitehouse.gov/presidential-actions/2025/05/delivering-most-favored-nation-prescription-drugpricing-to-american-patients/

9. Organisation for Economic Co-operation and Development (OECD). (2025, September). Economic security in a changing world. https://www.oecd.org/content/dam/oecd/en/publications/reports/2025/09/economic-security-in-a-changingworld_78f3b129/4eac89c7-en.pdf

10. See, for instance, European Commission. (2023). European economic security strategy. https://eur-lex.europa.eu/legalcontent/EN/ALL/?uri=JOIN:2023:20:FIN; G7. (2023, May 20). G7 leaders’ statement on economic resilience and economic security. https://www.mofa.go.jp/files/100506815.pdf